The Guide To Credit Builder Loans

When you have bad credit or no credit, simple tasks like taking out a loan, renting an apartment, or even getting a job are made much harder.

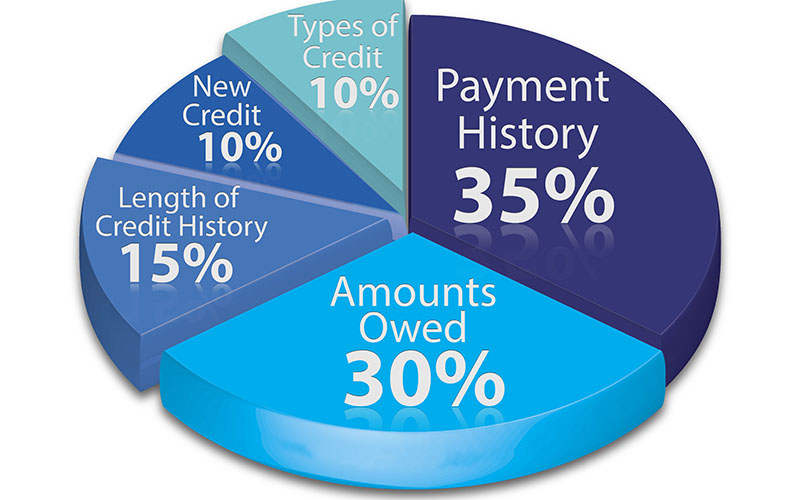

The reason? Having established credit history is important to lenders since they need to know whether an applicant will be able to pay them back. Your credit history shows your debts, payment history, and how likely you are to pay off a loan in the future. Without any visible credit or repayment history, lenders will most likely determine that you are too risky to lend to.

So what can you do? A credit builder loan may be a potential solution by helping you build or rebuild your credit to show potential lenders your positive credit history for the next time you need a loan, unsecured credit card, or mortgage.

What Is A Credit Builder Loan?

A credit builder loan is a tool that helps consumers with little, no, or bad credit to build their credit. A history of positive payments can help you generate a good score, which can eventually make it easier for borrowers to take out credit cards and loans with lower interest rates.

Credit builder loans are very specific loans offered by local banks and credit unions. The amount you borrow is held in a secured account while you pay off the loan. Once it is completely paid off, the funds are released to you.

Lenders report your payments to the three major credit bureaus: Experian, Equifax, and TransUnion; and as long as you are making on-time payments, this bureau reporting can improve your credit score.

Who Benefits From A Credit Builder Loan?

Credit builder loans are best for those who have little or no credit and need to improve their credit, like recent college graduates or those who are trying to rebuild their credit after serious financial problems.

How A Credit Builder Loan Works

A credit builder loan is like a regular loan in the sense that the payments you make are reported to the credit bureaus.

Paying off a credit builder loan shows lenders that you are serious about your financial health and that you are a trustworthy borrower who can pay back loans like unsecured credit cards, auto loans, and even mortgages.

The Benefits Of A Credit Builder Loan

Aside from building and building your credit history, credit builder loans have several other benefits:

- Credit builder loans help you save money since you are making monthly payments into a secured account. Once you have successfully paid off the loan, the funds are released to you.

- You learn good habits when it comes to saving money.

- Credit builder loans prepare you to take out larger personal loans in the future.

Before you take out a credit builder loan, make sure the financial institution reports to all three bureaus rather than just one or two of them in order to receive the full benefits of a credit builder loan.

The Disadvantages Of A Credit Builder Loan

While the benefits of credit builder loans are plentiful, there are a few disadvantages:

- If you miss any payments, these are reported to the credit bureaus and can backfire on your purpose of building a positive credit history.

- These loans are not free. Some lenders charge extra fees such as administrative fees and application fees.

Where To Get A Credit Builder Loan

Once you have decided that you want to build your credit, it's time to look for a loan. Fortunately, there are many options to find the best credit builder loan for you:

- Local banks and credit unions: If you are a member of a local bank or credit union, then this is a good place to begin your search. Because community banks and credit unions don't generate a large amount of profit, only around a quarter of credit unions in the US offer credit builder loans. To apply, you can visit a local branch in person or submit an application online. Qualifying for a credit builder loan usually isn't difficult since you won't need any credit history -- just sufficient income to cover your payments and (depending on the lender) some form of collateral. Be sure to weigh all your options -- loan terms, loan amounts, and interest rates -- before making a decision. We recommend choosing a loan with a low amount and a shorter term, which lets you build credit in a reasonable period of time and not worry about high monthly payments. Once you have been approved, the money you borrow is deposited into a secured savings account that you can only access when you have fully paid off the loan. When you have fully paid off your loan, you can collect your full amount along with any added interest. If you have successfully made on-time payments every month, you will also benefit from an improved credit score.

- CDFIs: There are around 1,000 Community Development Financial Institutions based in lower-income communities to specifically assist consumers who are struggling with their finances.

- Nonprofit organizations: Look for nonprofit organizations in your community that have resources to help you build your credit. Many of these other services such as filing your taxes and developing positive financial habits.

- Online lenders: If you can't find a credit builder loan through a bank, credit union, or nonprofit organization, then you will definitely find some options online. One of the current top online lenders for credit builder loans is Austin, Texas-based company Self Lender. Self Lender partners with FDIC-insured financial institutions such as Lead Bank and Sunrise Banks to offer these loans nationwide and without requiring upfront cash from consumers. To qualify for Self Lender, you need a valid bank account, debit card, or prepaid card. Additionally, Self Lender reports your payments to all three bureaus, which can greatly increase your credit score. There is no hard pull on your credit report (which will thankfully not damage your credit score) so you can't be denied due to low or no credit. However, Self Lender will check your ChexSystems report to see if there are any other negative strikes against you; you cannot have had a bounced check or unpaid fee in the previous 180 days. Their credit building loans start off as low as $25/month for a 24-month loan and interest rates are under 16%. Loan terms can range from 12 to 24 months. Consumers can receive loans of $525, $545, $1,000, or $2,000 with APRs up to 15.65%. Administrative fees range from $9 to $15 (which is included in the APR). The majority of Self Lender's borrowers reported that their credit score increased after paying off Self Lender's loan.

Alternative Ways To Improve Your Credit

If you are on the fence about credit builder loans, you can research some alternatives before making a decision and consider a different route:

- Secured credit cards: These are similar to a credit builder loan in the sense that they help build your credit, but you must have enough saved up to pay a security deposit. This lessens the risk for your lender and ensures that you are held responsible for your line of credit. Secured credit cards let you spend your credit limit, which could be the full amount that you deposited into a specialized account (usually anywhere from $50 to $300). Your bank issues a line of credit equal to your deposit and allows you to receive immediate access to your funds. Secured credit cards may have annual fees and interest rates that are higher than those offered by a credit builder loan -- sometimes as high as 25%. Make sure you make the full monthly payment so you can avoid paying interest; like with most lenders, you may have the option of autopay or alerts to pay your bill on time. Make sure that the lender reports to at least two of the three major credit bureaus. As long as you are making your payments on time, you can build your credit. Most banks allow you to upgrade to a traditional credit card once you have shown you are responsible for making on-time payments.

- Unsecured personal loans for bad credit: If you have bad credit or no credit but you need a loan for a specific purpose, you may opt to take out a personal loan for bad credit. An unsecured loan will not require any collateral, but due to your limited credit history, you will end up with much higher interest rates. Most reputable lenders will cap their interest rates at 36% -- anything above this is generally considered predatory, as is the case with payday loans. You should receive a lump sum of cash upfront to spend as needed. While this can be risky, you should see your credit improve as long as you pay your monthly installments on time.

- Secured personal loans: A secured loan works in almost the same way as an unsecured personal loan, except that you must put up some form of collateral (your savings, a security deposit, property, or a vehicle), which helps you receive lower interest rates than unsecured personal loans. However, this can also be risky -- you have the possibility of losing your collateral if you fail to keep up with your payments.

- Become an authorized user: Some credit card issuers allow the primary cardholder to add an authorized user to the account. This allows the new user to improve their credit by having an older credit card account added to their history. If you are new to credit and the primary cardholder shows 20 years of credit history and on-time payments, this will reflect positively on your credit history.

- Cosigning: If you can't get a loan on your own, you can consider getting a trusted cosigner with good or excellent credit to help you gain approval if you have bad or no credit. Unfortunately, this comes with its risks as well. Aside from potentially straining your relationship with your cosigner, you are also liable for their debts (and they are liable for yours). Any late or missed payments reflects on both of your credit histories.

- Credit repair service: If you have already established credit history and you are simply looking to improve it, you may want to consider credit repair. Any incorrect or unverifiable items on your credit report can be disputed and removed to improve your credit score. While you can improve your credit on your own, you can save time and get optimal results by hiring a reputable credit repair company.

- Credit monitoring. You can use a credit monitoring site like Credit Sesame or Identity Guard to monitor your credit and protect your financial information.

The Bottom Line

Credit builder loans can assist you in getting a start on building a positive credit history and approval on better interest rates and terms on credit cards, mortgages, and auto loans in the future.

However, it is extremely important that you take the process seriously by making your payments on time and monitoring any improvements on your credit score).

If you find that this isn't the best option for you, consider an alternative route such as credit repair, secured credit cards, or taking out a personal loan.

What is a credit builder loan?

Credit builder loans a specific loans offered by banks and credit unions to help borrowers with little, no, or bad credit to build and improve their credit history. Your lender will report your payments to the three major credit bureaus: Experian, Equifax, and TransUnion, which establishes and builds your credit history.

How can I get a credit builder loan?

There are many places where you can shop around to find the right credit builder loan for you:

- Local banks and credit unions

- CDFIs (Community Development Financial Institutions)

- Nonprofit organizations

- Online lenders (such as Self Lender)

Edited by:

Bryan Huynh

•

Product Tester & Writer