How to Improve Your Credit Before Buying a Home

Buying a home is a huge personal and financial decision. Along with finding the right home, you need to get the right mortgage.

Getting the best mortgage depends heavily on your credit, so if your credit score is on the lower side, you will wind up paying high interest rates.

If you're thinking of buying a home, then now is the time to fix your credit.

What Credit Score Do I Need To Get A Mortgage?

Your credit score plays an essential role in your financial decisions and knowing where it stands is especially important if you are planning on getting a mortgage.

Your credit score is an indicator of how likely you are to repay your debt and is scored based on the information reported to the three major credit bureaus. This score helps lenders decide what interest rates you pay on a loan. When you have good credit, lenders are much more likely to give you low interest rates since they see you as a low-risk borrower.

However, if you have bad credit, then lenders will view you as a risky borrower and charge you high interest rates -- that is, if they lend to you at all.

Your FICO® score ranges from 300-850 and is broken down in the following way:

800-850: Exceptional 740-799: Very good 670-739: Good 580-669: Fair 300-579: Very poor

The minimum credit score needed to take out a mortgage varies by lender, although most have a baseline score that is used to either approve or deny applicants.

Generally, a good credit score that is 700+ will help you get a fixed-rate mortgage with lower interest rates, but if your score drops below the mid-600s, you may start facing mortgage denials.

However, FHA and VA mortgages are easier for borrowers to receive, even with a credit score of around 500. These subprime loans will come with slightly higher interest rates and additional fees.

A loan backed by the FHA is most likely the best option for first-time homebuyers with bad or fair credit, since it allows them to receive a mortgage with subprime rates. Additionally, FHA loans consider applicants who have dealt with bankruptcy and foreclosure.

With an FHA loan, you pay a specific down payment with the following credit scores:

580+ = 3.5% down payment Below 580 = 10% down

However, if your down payment isn't high, you will have to pay mortgage insurance and costs the same amount regardless of your credit score, with an increase in price for down payments under 5%.

Other government programs -- such as VA loans and USDA home loans -- will also lend to borrowers with lower credit, but regardless of your credit score, most conventional mortgages will require a down payment.

How To Improve Your Credit

Get Your Credit Reports

Your first step should be to see where your credit stands. To find your credit score, which tells you where you stand with your lenders, you can turn to a credit monitoring service or company.

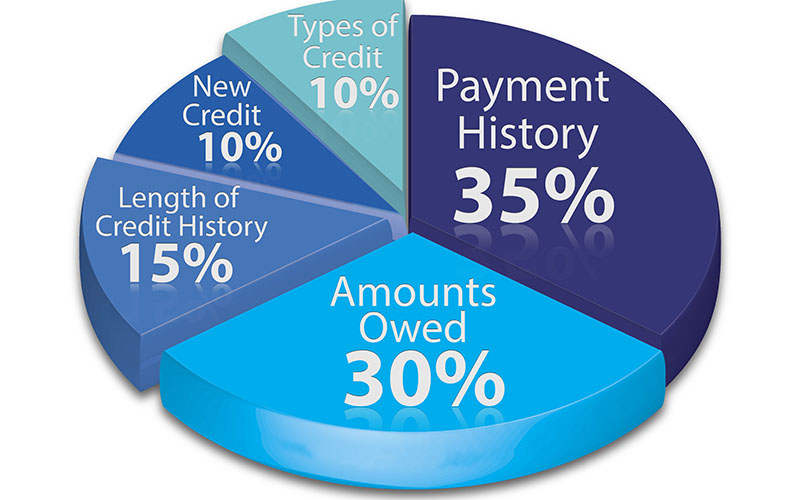

Your credit score -- specifically your FICO® score -- is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 10%

- Types of credit: 10%

Improve Your Payment History

As you can see from the FICO® score breakdown above, payment history makes up the largest percentage of your credit score. Late payments can damage your score and, when ignored, lead to other issues such as bankruptcy, collections, foreclosure, and repossession.

Late payments of 30 or more days will impact your credit less over time and fall off your credit report in seven years. To avoid this, you can set alerts in your calendar or set your accounts to autopay.

If you're struggling to make your payments, you can call your lender and ask for an extension, minimum payment, or payment plan. This won't always work, but it's worth trying if your credit is on the line.

Pay Off Your Debt

If you look at how your FICO® score is broken down, you'll see that credit utilization is the second-highest factor at 30%. Reducing your debt -- specifically revolving debt such as credit card debt -- is a simple but effective way to improve your credit.

With revolving debt, you generally want to keep your credit utilization (aka the amount you use versus the total credit limit) to less than 30%.

Repair Your Credit

You should order a copy of your three-bureau credit reports to give you an overview of your credit history. FTC law allows you to receive one free copy of your credit report once a year from the three major bureaus, Experian, Equifax, and TransUnion.

Once you get a copy of your credit report, check it for any inaccurate, unverifiable, or outdated negative information. These items can be disputed and removed with the bureaus. You can either do this on your own or hire a reputable credit repair service to do the legwork for you. We recommend using a credit repair company over doing it yourself (especially if you are new to building credit) since they know the ins and outs of credit repair.

Items to look for include:

- Incorrect personal information such as name misspellings

- Incorrect, duplicate, or fraudulent accounts

- Incorrect payment statuses

- Outdated accounts

- Incorrect dates on delinquent accounts

- Information or accounts from an ex-spouse

Request Rapid Rescoring

Mortgage lenders may help you raise your credit score through a process called rapid rescore, in which accurate information is reported to the bureaus to replace inaccurate information within five business days instead of the usual 30 days.

However, this can only be done by a lender or company (usually mortgage lenders) that specializes in rapid resourcing and has access to credit information.

Additionally, only inaccurate or unverifiable information can be fixed.

Don’t Open Any New Accounts

Avoid opening any new credit accounts before trying to get a mortgage since new inquiries can damage your credit slightly.

Additionally, too many inquiries in a small window of time indicate to lenders that you are in need of extra credit; however, if these inquiries were made within 14 days, the bureaus will only count it as one.

Don't Close Any Old Accounts

Old credit accounts are seen as a positive for your credit and makes up for 15% of your FICO® score, so make sure not to close them. You should also use them to make a small purchase once in a while since inactive accounts can be closed.

Become An Authorized User

Ask a trusted family member or friend with good credit to add you as an authorized user to their accounts. Keep in mind that their credit -- along with yours -- is on the line if not used responsibly.

Consider Using A Co-Signer For Your Mortgage

Not sure whether or not you will qualify for a mortgage? Ask a trusted family member or friend to co-sign the loan to qualify for a better loan. Just remember, just like being an authorized user, everyone's credit can be damaged if you default on the loan.

Prequalify And Compare Your Rates

Prequalify for a mortgage online to see how much you will ultimately be paying and if you can afford it. Lenders will offer rates and terms based on your creditworthiness, income, tax records, and other financial documents.

Prequalification (which does not necessarily indicate preapproval) allows you to see your total mortgage, monthly payment, and the highest amount you may qualify for.

Always shop for the best rates through an online lender, through a physical location, or a mortgage broker.

Before you decide on a loan, you should also consider the accompanying fees, closing costs, and whether you want a fixed or variable rate mortgage.

The Bottom Line

Need more information on how to fix your credit? Turn to our reputable services here.

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Renting a house or apartment (without putting down a hefty deposit)

- Lower mortgage payment

- A lower down payment when you purchase a cell phone

- Lower utility bills

- Your insurance premiums depend on it

- Potential employers may look at your credit history to determine reliability

- It will be easier to qualify for loans

- You will receive lower rates on loans

- You will qualify for better credit cards

What factors make up my credit score?

Your FICO® is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 10%

- Types of credit: 10%

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

How can I improve my credit?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

Edited by:

Bryan Huynh

•

Product Tester & Writer