How to Refinance a Loan With Bad Credit

When you have a high interest rate on a loan, you'll probably end up paying many times more than what you originally took out on your loan.

Refinancing can help you save more money by either receiving a lower interest rate or reduce your repayment amount, but if you have bad credit, it'll be much harder for you to be approved for a loan refinance.

Luckily, you may still be able to refinance your loan if you take the right steps. Below, we look at how you can refinance different types of loans (auto loan, mortgage, student loan) even with bad credit.

How It Works

What is loan refinancing? Refinancing allows you to take your current loan terms and replace them with new -- and ideally better -- terms. Your new loan will pay off your previous loan and you'll begin making your payments to your new lender.

Your refinanced loan will come with lower interest rates or reduce your repayment amount. This is ideal if you are having trouble making your monthly payments and/or need more time to pay back your loan. On the flip side, you can refinance your loan to have a shorter term to pay it off faster.

Auto Loans

You can refinance an auto loan with bad credit but you should calculate your total costs with your new loan to make sure you won't end up paying more than your current loan -- refinanced loans may come with additional fees such as prepayment penalties. Additionally, extending your loan term can help you receive lower monthly payments but you may end up paying more in interest.

Refinancing a loan may also be beneficial if the current interest rates are lower than what you received when you first took out the loan.

Before deciding on a refinanced loan, make sure that you check out all of your available lenders, including online networks and those who specifically work with bad credit. You should also ask your current lender if they will provide a refinancing deal since they will probably want to keep you as a customer and you may be more likely to qualify if you've been making on-time payments -- not just on your auto loan, but your other bills as well.

You should also check your credit and see where you stand. If you have any recent negative items such as delinquencies or bankruptcies, that may be a red flag for lenders. You typically want to have 6 to 12 on-time payments before trying to refinance, which not only benefits your credit but shows lenders that you are a reliable borrower.

It's not necessary to improve your credit since interest rates fluctuate and may drop over time, but it can be helpful. However, if you can't qualify for any loans with your current credit, then you may want to work on improving it; you can also ask a trusted family member or friend with good credit to cosign a loan in order to qualify and/or receive lower rates.

If you're ready to refinance, we recommend Auto Credit Express, which is one of the largest loan refinancing networks that is well known for working with consumers with bad credit. For more information, check out our in-depth review here.

Mortgages

Refinancing your mortgage can help you secure a lower interest rate, lower monthly payment, and/or a shorter repayment term. However, refinancing a mortgage is slightly trickier than refinancing an auto loan.

When it comes to refinancing a mortgage, your credit plays an incredibly important role. Lenders may be unwilling to extend loan refinancing if your credit score is too low.

Generally, a FICO score of 670 (which is considered good on the FICO scale of 300 to 850) is the best way to receive lower interest rates.

It takes time and good financial habits to improve your score (more on that later), but there are other steps you can take to help you secure refinancing:

- Have savings set aside, which shows lenders that you are responsible with your finances and have cash on hand in case of an emergency.

- Apply with a non-occupying co-client, who is someone that doesn't live in your home but will take responsibility for your loan if you default. Your lender will look at both you and your co-client's credit scores, income, and additional assets. In some cases, your co-client may need to be on the title of your house. Just like with a cosigner, your co-client's finances (and your personal relationship) are on the line if you fail to pay back your loan.

When your credit is less than stellar, your best option is to shop around for loan programs that have relaxed credit requirements. Here are some options to refinance your mortgage with bad credit:

- FHA Refinance Loans: FHA loans are insured by the Federal Housing Administration and have more lenient credit requirements than other types of mortgages -- usually between 500 and 580.

- FHA Streamline Refinance: In order to qualify for this, your mortgage must be an FHA loan and you must be current on the payments. You have the option of choosing one of the two types of FHA streamline refinance loans: * Credit-qualifying: FHA streamlined credit-qualifying means that the borrower provides income and asset documents like a regular refinance. This shows that they qualify for the new mortgage and lenders will provide their preferred pricing. Debt-to-income ratios can't exceed 45%. * Non-credit qualifying: FHA streamlined non-credit qualifying means that income documentation is not provided or stated on the loan application. There is no credit check, home appraisal, or calculation of your debt-to-income ratio. Because of this risk, interest rates are usually higher.

- FHA Rate and Term Refinance: Any type of mortgage can be refinanced into a rate and term FHA refinance. "Rate and term" simply means the ability to get lower rates or change the loan. This type of refinance requires lenders to do a credit check and calculate your debt-to-income ratio.

- FHA Cash-Out Refinance: An FHA cash-out refinance allows borrowers to tap into their home equity -- up to 80% of the home's value. The FHA requires a minimum credit score of 580 to refinance, although other lenders may require higher scores. If you are looking to take out cash, you will need a minimum score of 620.

- VA Refinance Loans: VA loans are guaranteed by the U.S. Department of Veterans Affairs. These are specifically for military service members, veterans, and certain surviving spouses. There is no specific credit score for purchase or refinance loans but lenders may have their own requirements.

- VA Streamline Refinance: If you have a VA loan, you can refinance with a VA Interest Rate Reduction Refinance Loan to either lower the interest rate or switch from an adjustable to a fixed rate. The VA doesn't need a credit check or appraisal but a different lender may require it.

- USDA Streamlined Assist Refinance Loans: USDA mortgages are backed by the U.S. Department of Agriculture and are specifically for rural homebuyers. You must already have a USDA mortgage to use the streamlined assist refinance loan. In most cases, this doesn't require a credit check, debt-to-income calculation, or home appraisal, but you should be current on your mortgage for a minimum of 12 months before applying.

- Freddie Mac Enhanced Relief Refinance and Fannie Mae High Loan-to-Value Refinance: These two programs are a replacement for the Home Affordable Refinance Program (HARP) and allow you to refinance if you owe more than what your home is worth and are specifically for homeowners who wouldn't qualify for refinancing due to owing more than 97% of their home value.

- VA IRRRL: A VA Interest Rate Reduction Refinance Loan allows you to refinance either your rate or term an existing VA loan without a credit check, home appraisal, or income verification. However, you must have made a minimum of six consecutive on-time payments and there must have been a minimum of 270 days from when you closed on your VA loan to when you plan to refinance.

- Remove Mortgage Insurance: If you have an FHA loan, you are required to pay Mortgage Insurance Premium (MIP) as long as you have an FHA loan if you put down less than 10% on the home. Homeowners can keep their FHA loan until they reach 20% equity and then refinance to a conventional loan, which allows them to save money by forgoing the mortgage insurance.

Student Loans

When it comes to student loans, your credit plays a large role in what you qualify for. However, there are some important steps you can take to help you qualify for a better deal:

- Always pay on time. A history of on-time payments will help lenders view you more favorably.

- If you have defaulted student loans, try to pay them off to bring them current.

- Ask a trusted family member or friend with good credit to cosign. (Remember, if you default, they will be expected to cover the expenses and their credit will also be damaged.)

- Look to multiple lenders -- whether they are online networks (such as SoFi), banks, or credit unions -- and compare your rates and terms to find the best offer.

Improve Your Credit

Regardless of what type of loan you are looking to refinance, improving your credit can help in a multitude of ways:

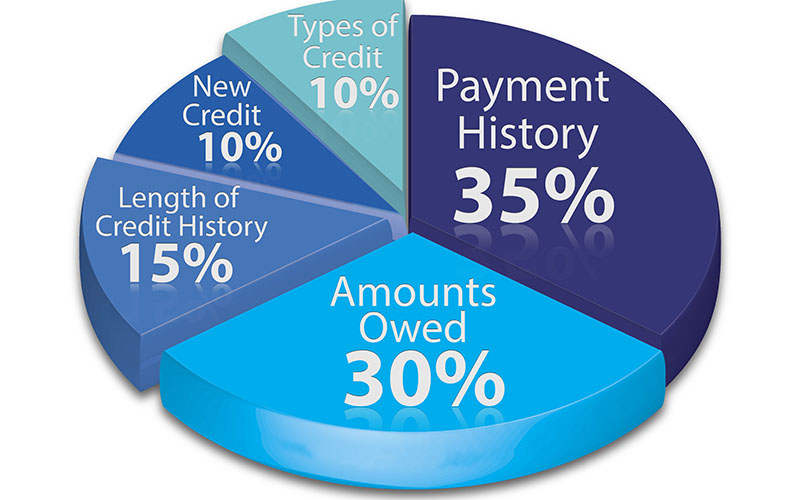

- Negative information will stay on your credit report for anywhere from 7 to 10 years. You can, however, dispute inaccurate and unverifiable information with the three bureaus (Experian, Equifax, and TransUnion) and have them removed. Be sure to get a free copy of your three-bureau credit report once a year at AnnualCreditReport.com.

- Pay your bills on-time to avoid late payments.

- Lower your credit utilization -- the less available credit you use, the better your score.

- Consider taking out a secured credit card or credit-builder loan. As long as you use both responsibly, these are safe methods to improve your credit.

Need more information on how to improve your credit? Turn to our reputable experts here.

Can refinancing a loan negatively impact my credit?

Submitting an application for loan refinancing generates a hard inquiry which causes a temporary drop in your credit score (usually a few points). Loan refinancing may also impact your credit since your original loan is paid off early and replaced by a new loan, thus reducing the age of your accounts.

Can I refinance my loans if I have low income?

Yes, but before finding a lender who will work with you, aim to improve your credit so you can qualify for better terms.

Should I refinance my loans?

If you have good credit, a reliable job, and multiple loans, then it may be worth it to refinance your loans. However, if you are in an unstable financial situation, you might want to wait until you have more financial security before you refinance your loans.

What are the downsides of refinancing loans?

Refinancing your loans has many benefits, but there are some cons, such as having to meet strict eligibility requirements, getting locked into a set repayment plan, and limited flexibility.

Edited by:

Bryan Huynh

•

Product Tester & Writer