Free Tax Preparation Checklist - File Your Taxes the Right Way

Almost Tax Time? Follow the Ultimate Tax Preparation Checklist

Every April you go through the same routine: You rush to collect all your income information, organize your receipts, and prepare and file your tax return as quickly as you can before the deadline.

But as you know all too well, leaving everything to the last minute is stressful. And what else, you could be leaving money at the table!

Starting your tax preparation earlier – even as soon as you receive your W-2 from your employer – can help alleviate tax-time stress and help you make the most out of any income adjustments and deductions.

With this tax prep checklist, you’ll learn what you need to prepare and file your taxes for fewer headaches come next tax season.

Why You Need Tax Prep

No one likes to prepare and file their taxes, even when they expect a refund. And who would rather spend a Saturday buried in paperwork and calculations than out doing something fun?

But preparing and filing your taxes on time – even early – each year is not only the law, but it’s also in your best interest.

If you wait until the last minute to work on your tax return, you’re more likely to skip deductions or make errors that could end up costing you thousands of dollars. The more time you give yourself to prepare your taxes, the more time you have to make sure everything is accurate and you’re making the most of deductions.

For those who are owed a refund on their state or federal taxes, earlier filing also means earlier access to that refund cash.

It’s much better to get your tax preparation started early so you have time to correct any errors or gather additional information if you need it.

What To Do Before You Start Preparing Your Taxes

Before you start working on your tax return, you want to make sure you have all your documents and information gathered together.

This will make preparation faster and easier, decreasing the amount of frustration you may feel with the overall process of preparing your taxes.

Gather Your Personal Information

First, gather all your necessary personal information. This includes:

- The Social Security or tax identification number for everyone on your return. This includes yourself, your spouse (if you’re filing married filing jointly), and any dependents you plan to claim

- The date of birth for everyone on your return

Before you plan to claim a dependent, be sure that you know the rules for claiming someone as a dependent on your tax returns.

In order to qualify as a dependent, each person must:

- Must not have filed a joint tax return for the year unless it’s to claim a refund.

- Must be a U.S. citizen, U.S. national, or resident alien.

- Must have a taxpayer identification number. This is usually a Social Security number but can also be an Individual Taxpayer Identification Number (ITIN) or Adoption Taxpayer Identification Number (ATIN).

Dependents can file their own tax returns for the year, and even can be married.

If you plan to claim a dependent who is a child, they must meet the following requirements:

- The child has lived with you for at least half the year.

- The child has to be related to you as a son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of those.

- The child must be 18 years old or younger, or under 24 if a student. To be considered a student, the child must have attended school full-time during at least five months of the year, though the five months do not have to be consecutive.

- The child must be younger than you (or your spouse if you are married filing jointly), unless the child is disabled.

You also can claim other relatives and unrelated people who live with you as dependents. They have to meet the following criteria:

- Have a gross annual income of less than $4,150 (or the amount required to file a tax return for the tax year).

- Cannot qualify as a child or dependent of another person.

- Must be related to you or have lived with you all year as a member of your household.

Organize Your Financial Information

Next, you will need to gather important financial information that will be necessary for preparing your tax return.

Be sure you have thorough information about your income and investments, including:

- Form W-2 Wage and Tax Statement: This is a form sent to you by your employer that lists how much you made during the tax year and how much was withheld for taxes. If you did not receive your W-2, request it from your employer.

- Bank or financial institution statements: You may receive several types of bank statements depending on your investments and financial accounts. If you contributed to an IRA, you should receive a Form 5498. If you’re paying off student loan debt, you’ll get a Form 1098-E. For those with a home mortgage, you’ll get a Form 1098 Mortgage Interest Statement.

- Last year’s state refund amount: If you received a refund from the state last tax year and plan to itemize your deductions, you will need to know the amount to claim as income.

- Other financial records: These records may include gambling winnings, prize money, lottery pay-outs, or any other income you received that does not qualify for a 1099.

- Any Form 1099s: There are a variety of Form 1099s, and you may receive one or more of them for reasons including: self-employment, receipt of government benefits, receipt of a payout from a retirement account, or receipt of dividends.

How To Prepare For Deductions And Credits

Once you have all the information about your income collected, it’s time to start thinking about what deductions and credits you qualify for and gathering supporting information for them.

Collect Self-Employment And Business Records

If you are self-employed or own a business, collecting complete records of all possible deductions for your business is important to maximizing your return.

Some records you may need include:

- Business expense records: These may include receipts, credit card statements, or check registers.

- Quarterly estimated tax payment receipts: If you pay installments on your tax bills during the year, the IRS and your state should send you a receipt for these payments.

- Mileage records: You must have clear, thorough records of how many miles you drove for business purposes. Mileage to and from your house do not count, unless your home is your official business address.

- Home office expenses: If you’re claiming a home office deduction, you need to have proof of all expenses related to your home office based on the method of home office deduction you plan to claim. This includes records of insurance, utilities, and even mortgage interest.

Save Medical Expense Receipts And Records

For those planning to itemize medical expenses on their tax returns, additional documentation of medical expenses are necessary.

Some information you need to collect includes:

- Receipts for unreimbursed medical expenses: This includes any copays for office visits, surgeries, hospital stays, or preventative care. You may also include expenses for braces, glasses, hearing aids, and prescriptions.

- Form 1095: Health insurance coverage forms: Individuals covered through the insurance marketplace should receive a Form 1095-A. If you have private insurance, your provider sends a Form 1095-B. Your employer will send a Form 1095-C if you are covered by their insurance.

- Social Security benefits: People who receive Social Security benefits will be sent an SSA-1099 showing the total amount of benefits received.

Track Charitable Donations

Donations you make to registered charities, whether they be of money or items, can be itemized as deductions on your tax return.

In order to claim these deductions, you will need a receipt for your donation from the charity.

If you donated items, such as taking your old clothes to a charity thrift store or donating an item for an auction, the organization will leave valuing your donation up to you. The IRS allows you to claim the fair market value of the items as a deduction, though some allowances can be made if the item donated appreciated in value from fair market prices.

Look Into Deductions for Homeowners

If you own a home and pay property taxes, you can write off a portion of those taxes on your return.

Be sure you have a receipt for taxes paid - this usually comes from the municipality that levies the taxes - to include with your return.

A Note About Income Adjustments

There are a number of ways you can reduce your taxable income, increasing the amount you receive in a refund or decreasing the amount you owe.

Talk with a tax professional to see if any of the following income adjustments apply to you:

- IRA contributions

- Energy credits

- Student loan interest

- Medical Savings Account contributions

- Moving expenses (for years prior to the 2018 tax year only)

- Self-employed health insurance payments

- Keogh, SEP, SIMPLE, and other self-employed pension plans

- Alimony paid that is tax-deductible

- Educator expenses

Need Help? Hire A Tax Prep Expert

Many taxpayers prefer to work directly with a tax professional when preparing their tax returns.

The knowledge and experience these experts have provides a level of comfort in knowing their returns are completed correctly and thoroughly.

If you are self-employed or own a business, it’s highly recommended that you hire a tax professional to help you prepare and file your tax return. A licensed accountant can help you understand what deductions and credits you qualify for, and ensure that all your calculations are correct.

But with so many tax professionals out there, how can you find one that fits your individual needs?

Here are seven tips for hiring the right tax expert to prepare your taxes:

1. Request a Preparer Tax Identification Number

The IRS requires that anyone who gets paid to prepare or assist in preparing taxes have a Preparer Tax Identification Number (PTIN).

Your chosen tax preparer should have this number readily available, showing you they are compliant with regulations.

2. Check for a CPA, Law License, or Enrolled Agent Designation

Having a PTIN is great, but to find a true tax professional you want to find someone with educational and licensing credentials.

Look for a Certified Public Accountant (CPA), a law license, or an Enrolled Agent designation.

These show you that your chosen professional has completed education and passed exams, and participates in ongoing education in tax preparation.

3. Look for Professional Associations

Tax professionals can belong to a wide variety of professional associations and organizations.

Membership in a professional organization such as the National Association of Tax Professionals, the National Association of Enrolled Agents, the American Institute of Certified Public Accountants, or the American Academy of Attorney CPAs shows that your professional abides by ethics codes, professional conduct requirements, and certification program requirements.

4. Compare Fees

The cost tax preparers charge varies greatly on the complexity of your return and the region where you live.

When looking for a professional to work with, find someone who either charges hourly or charges a flat fee for tax preparation.

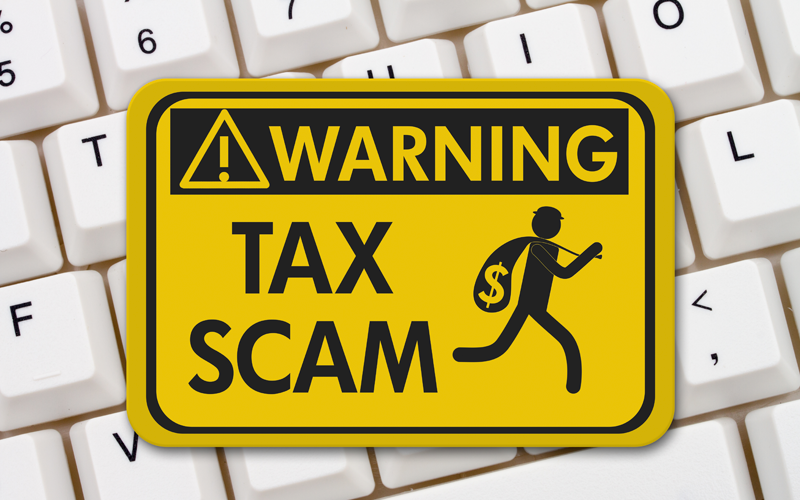

Tax preparers who charge based on the amount of your refund or who say they can get you a bigger refund than anyone else should be avoided.

5. Check for E-Filing

The IRS requires any tax professionals who prepare more than 10 tax returns to use the e-filing system.

Someone who doesn’t e-file is a sign that the person may not be doing as much tax prep as you may think.

6. Make Sure They Sign

The law requires all professional tax preparers to sign clients’ returns and provide their PTINs.

If you’re handed a blank tax return, don’t sign it. Your preparer could have put anything in it and, if you get audited, you’re on the hook for all the mistakes.

7. Watch Your Back

If you get audited or there’s an issue with your return, you want to make sure the person who prepared your return can help you out.

Tax preparers with a PTIN cannot represent you in front of the IRS. CPAs, attorneys, and Enrolled Agents, on the other hand, can.

Be sure to find a tax preparer who’s qualified to help you in case you run into a sticky situation with the IRS.

Find A Reputable Tax Prep Professional

Sorting through the lists of CPAs, EAs, and other tax preparers in your area can make it difficult to find the right professional for your needs.

At the Credit Review, we’ve compiled a database of highly-rated tax professionals who can help you with everything from preparing and filing a routine tax return to negotiating with the state or IRS over unpaid taxes.

Edited by:

Bryan Huynh

•

Product Tester & Writer