What Are Tradelines And How Do They Affect My Credit?

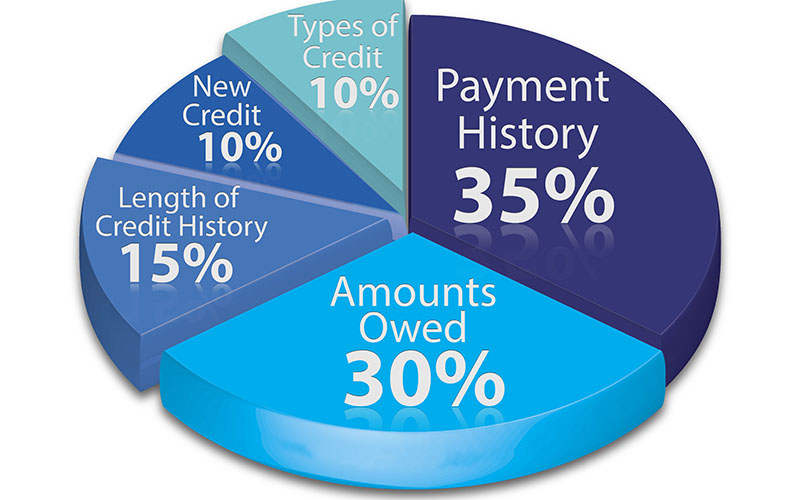

In the credit industry, a tradeline is a term used to describe credit accounts on your credit report. Each revolving and installment account -- such as a credit card, mortgage, auto loan, etc -- has a tradeline that includes information about the creditor and debt.

Why are tradelines important? Having good credit habits lead to good tradelines, which can help your credit.

Information On A Tradeline

The information reported by lenders will remain on your credit report until it ages off and includes:

- Credit or lender's name and address

- Type of account

- Partial account number

- Date the account was opened

- Date the account was closed, if applicable

- Current status

- Date of last activity

- Current balance

- Original loan amount or credit limit

- Amount of the last payment

- Date the account was last updated

- Payment history

- Current account status

- Recent balance (for credit cards only)

- Any delinquencies in the past seven years

While lenders will try to report the most accurate and recent information about your accounts, they may report it differently, resulting in variations in the information on your tradelines.

You can review the information on your tradelines by looking at your credit report. FTC law entitles you to one free credit report each year from each of the three major bureaus, which you can order by visiting AnnualCreditReport.com.

If you find any inaccurate, unverifiable, or outdated information, you can dispute these with the credit bureaus (Experian, Equifax, and TransUnion) and have them removed. Tradelines that you don't recognize and didn't authorize could be a sign of identity theft.

How Tradelines Work

When you have bad credit, you can take steps to improve it by making on-time payments, paying off your debts, and removing inaccurate negative items from your credit reports.

Individuals with good credit will have tradelines that show positive credit history and those with bad or poor credit will generally have tradelines that show negative information, such as late payments and high credit utilization.

Buying Tradelines For Your Credit Report

If you want to improve your score quickly and don't want to wait, you can actually buy a tradeline.

Buying a tradeline means you can have your name added as an authorized user to another individual's account they for a short period of time -- which may boost your credit as long as they have good credit as well. The tradeline will appear on your credit report long enough to boost your score so you can apply for credit.

Tradelines are a legal way to improve your credit, but lenders may look into your relationship as an authorized user to the primary account holder and take this into consideration when looking at your application. Instead of buying a tradeline, you can consider asking a trusted family member or friend to become an authorized user on their account instead of buying a tradeline.

Having positive tradelines may help your credit, but too many tradelines may indicate to a lender that you are inexperienced with credit and potentially overextended. However, there is no official amount of specific tradelines that are considered too many. Ideally, you should only keep credit accounts that you need and use them responsibly. Too many new tradelines can cause lenders to deny an application.

Getting Removed From A Tradeline -- And How It Affects Your Credit

When you remove a tradeline with positive information on it, it can negatively impact your credit.

Removing a tradeline isn't always a bad thing though. If you have a tradeline with fraudulent or negative information, this can help your credit.

In general, a tradeline will stay on your credit report around two to six months, depending on the type of tradeline and company you used. Closed tradelines with negative information will eventually fall off your credit reports in 7 to 10 years.

Tradeline Benefits

Why would a tradeline with positive information benefit you? Here are some reasons:

- Improve your chances of getting accepted for a new loan.

- Receive a lower interest rate on car insurance, loans, mortgages, and more.

- Have a better chance of receiving that job. Many potential employers review credit history before hiring since a good credit score generally means better reliability

- Receive approval or a lower deposit when renting a home or apartment. Just like a potential employer, landlords will review a potential tenant's score to assess their risk.

Tradeline Drawbacks

Tradelines have the ability to help your credit but they do come with some pitfalls:

- Buying a tradeline is a temporary solution to a long term financial journey. Your credit will only improve for a short period of time and tradelines are not a substitute for other ways to improve your credit, such as credit repair, opening a secured credit card, and/or taking out a credit-builder loan.

- Creditors are aware that many people will buy tradelines to improve their score and may turn you down for a loan if you have a tradeline listed but don't have more information about your standing as an authorized user.

- Not all tradeline companies are trustworthy, so you must do your research before purchasing tradelines.

How To Find A Good Tradeline Company

Buying a tradeline from a reputable tradeline company can range anywhere from several hundred to several thousand dollars. You will most likely pay more for "seasoned tradelines" that have a long payment history, low credit utilization (under 30%), and no delinquencies.

Looking for a tradeline company? Here are some things you can look for:

- A knowledgeable staff that takes the time to help you find that you're looking for rather than just selling tradelines without truly assisting you.

- Personalized service and dedicated customer support that can help you evaluate your goals and decide on a tradeline that fits your budget. You should be able to contact them easily through a support number or email address.

- Look for a company that has industry experience and has been in business for a long time. It's also beneficial to look at how many customers they have served, as this is an indicator of their knowledge and experience.

- Look for a physical address for the tradeline company. Any tradeline company that doesn't provide transparency on their location or company information should be avoided since they could be scammers. A reputable tradeline company will show the number of seasoned tradelines for sale and be open, honest, and in full compliance with the law.

How To Buy A Tradeline

While the exact process of buying a tradeline varies by the lender, it is typically similar across the board:

- Choose a tradeline -- or tradelines -- that fits your need and budget

- Read the contract to double-check how long you will be added as an authorized user before you sign it

- Complete the secure payment process online or by phone

- Upload copies of any required documents, such as your driver's license or Social Security card

- Along with the updates you will generally get with your tradeline company, check your credit report and continue to monitor your credit for the changes you will see on your credit report

The Bottom Line

Tradelines are a legal and legitimate way to boost your credit short-term and help you qualify for loans, mortgages, and other types of credit. However, you should consider your long-term options to improve your credit such as enlisting a credit repair service.

Looking for more information on improving your finances? Look for more of our reputable services here.

What is a tradeline?

Tradelines are the term for the accounts on your credit report, such as your credit cards and loans.

Are tradelines illegal?

Tradelines aren't illegal, but buying credit and paying for tradelines can be viewed as unethical by creditors and lenders.

Can a tradeline boost my credit?

If your tradeline has a history of on-time payments and you use less than 10% of the available credit, then it has the potential to improve your credit.

Edited by:

Bryan Huynh

•

Product Tester & Writer