- Home

- Business Banking

- Optimizing Account Balances (for Maximizing Cash Flow in your Business Account)

Optimizing Account Balances (for Maximizing Cash Flow in your Business Account)

Key Takeaways

- Effective cash flow management is crucial for businesses to avoid financial issues, involving strategies like invoice automation and inventory liquidation.

- Businesses need to understand and manage typical banking fees such as transaction and maintenance fees to optimize their account balances and reduce costs.

- Implementing cash management tools like cash sweep programs and automatic transfers ensures efficient operational cash flow.

- Regular monitoring of account activities and forecasting future financial needs are essential to maintain business solvency.

- Consolidating accounts simplifies cash management, and negotiating with banks can improve financial terms, enhancing overall financial health.

So you’ve got your business up and running, and you’ve started making consistent annual profits. What’s the worst that could possibly happen? Going out of business? Losing investors? Or maybe even getting overtaken by competitors.

We wouldn’t blame you if those were the things you first thought of.

It’s only natural for any entrepreneur to have such situations pop up in their head when thinking of losses. Similarly, another such problem is very easy to overlook but not as easy to handle. In case you haven’t guessed it yet, we’re talking about cash flow issues in business banking. You may very well make profits on paper and, at the same time, go out of business if you don’t manage your cash flow well enough.

Now that we have a clear idea of the problem, what’s the solution? There are many ways of solving cash flow problems or even preventing them from happening in the first place, such as automating invoices, liquidating inventory, or even optimizing account balances. We’ll focus on the latter half - optimizing account balances for today.

Understanding Account Fees/Charges

You can’t really optimize your account balance unless you’ve got a good grasp of the different charges/fees banks charge for a business checking account. Let’s take a good look at some of the account fees/charges banks typically impose:

Transaction Fees

The most well-known (and even relatable) fee banks charge is for making a wire transfer. If you wish to send funds to a client, supplier, etc., who holds an account in another bank, you’ll be charged a small amount.

Under most circumstances, this should only be up to $40 at maximum for domestic transfers, while international transactions may be more expensive. Ensure that you look at the transaction fees of a bank before opening a checking account with them.

Maintenance Fee

As part of maintaining your account, banks can often charge you a monthly service fee if you don’t meet some requirements. For example, banks may ask you to maintain a minimum balance in your account or maybe even spend above a threshold on your debit card.

The good news is this fee can usually be avoided by ensuring you don’t go below the minimum required balance or having multiple accounts in the same bank. You can negotiate with your bank regarding the maintenance fee and see if it can be waived.

Transaction Limit

The last type of fee you should know about is also related to making transactions. While this does not apply to all, some banks will charge you a fixed amount if you make more transactions than the specified limit.

It’s crucial to know that if you don’t pay proper attention, these fees/charges can slowly bite into your profits and hamper your cash flow. However, banks do offer businesses a sort of extra service where they can lower or completely cancel out these charges for you.

Implementing a Cash Sweep Program

The cash sweep program allows businesses to utilize their excess earned money and pay off any remaining debts. Instead of distributing the money to shareholders, a sweep account can automatically send funds to another account with predefined rules.

Using this can also help you get rid of debts before the required time frame. There’s a common formula that businesses can use to calculate the cash sweep.

Cash sweep = Total cash - Minimum cash needed to run business operations.

The “minimum” cash here is a guess and will vary from one company to another. As an owner, you can find out how much money you need to run the operations of your business via your accountant.

Setting Up Automatic Transfers to Maintain Optimal Balances

When you start a company, budgeting becomes an essential part of financial planning. It basically assists businesses in picturing where exactly the money will be utilized.

This may sound really important, but in reality, budgeting is time-consuming as you have to figure everything out. It may not be a matter of concern when you’re a small-sized business, but as your firm scales, it becomes hectic.

With automation in the picture, these cumbersome tasks become easier to handle. You can set up instant transfers to keep the cash flow running. A few other examples of automatic transfer include:

- Same day transfer

- Next business day transfer

Adjusting Account Balances to Meet Changing Business Needs

Adjusting account entries refer to unrecognized income or expenses which are not recorded during the year of that transaction.

For example, your business provides services to a client, and you're to be paid in the future. Now normally, you would record this entry into your accounts receivable but have to wait until the money reaches your bank account to complete the entry.

Such transactions are divided into four categories including:

- Accrued expenses (also referred to as accrued liabilities)

- Prepaid expenses

- Accrued revenue

- Unearned revenue (also referred to as deferred revenue)

_But how is this related to meeting changing business needs? _

We’re just around the corner to cover this. You may have understood that a mismatch or discrepancy while recording adjusting entries can cause inaccurate financial statements.

This would mean that a business is not following the matching principle – revenue and expenses need to be recorded in the same period. When you’re taking care of the adjusting entries, you see to it that business activities are conducted correctly and not paying for expenses before they are incurred.

Adjusting account balances translates to a clear picture of financial stability. So when your business has to make necessary changes, you would now be in a better position to manage it.

Monitoring Account Activity to Prevent Overdrafts and Fees

If you have eyes on how much money comes in and goes out, you can easily avoid different fees and even overdrafts. Here are some different steps you can undertake to ensure that you monitor your bank account activity properly:

Keeping Record of Transactions

A good practice is keeping a record of the transactions your account experiences over a period of time. Whether it be sending money to others, paying salaries, or filing your tax returns, keep checking how much money each transaction normally takes.

This will help you (or your accountant) identify any inconsistencies with the numbers and make any necessary changes.

Be Aware of Present Balance

For this one, you can either use your bank statements or bank mobile applications. Ensure you’re always up-to-date with how much money you currently hold. With information on the amount you can spend at the moment, you’ll avoid overspending and overdrafts in the first place altogether.

Have a Cash Reserve

While it is important to monitor your account activity, it is just as important to ensure that you have some extra funds at hand whenever there’s a miscalculation. After all, we’re all humans, and mistakes are expected. However, preparing for such mistakes beforehand will make sure you have buying power when needed.

Consolidating Accounts to Reduce Fees and Simplify Cash Management

Having multiple accounts to deal with and do business only complicates things. Not to mention it is even costlier to do so. Hence, consolidating your assets (combining entities or assets in one) is a healthy practice to boost efficiency while also lowering costs.

Hence, if two companies join together and put all their assets, liabilities, and debts into one unit, it significantly improves their market share and enables their businesses to scale further. So, when companies agree they need to expand their organization and increase profits, merging them is a great option.

Moreover, by incorporating two or more companies, management teams can have access to more resources and thus make better financial decisions to keep the cash flow running.

Negotiating Favorable Fees With the Bank

Cutting down costs means freeing up more cash, right?

A little negotiation with the bank can do this trick. If you want to obtain less fees, then you need to step up and ask for it. Now, this in no way means you just walk up and persuade the bank partner for a fee reduction. Instead, fostering a relationship with the bank can help you get the best rates.

Audit your current fees and analyze the data to get a better idea of the bank’s practices. Remember that a mutual understanding coupled with a deep relationship with the bank can yield favorable results.

Using Online Banking Tools to Track and Manage Account Balances

The adverse effects of not managing or monitoring cash flows often include poor liquidity, higher cost, and confusion, which leads to poor decision-making.

No business could risk this. Here’s where online banking tools come into play. As financial technology becomes more prevalent, there are plenty of ways to track and manage your account balances.

With these intelligent systems by your side, you can effortlessly monitor cash flow in real time, check balances, track expenses, transfer money, and much more. Companies can adapt to situations and manage account activities using the right tools.

Creating a Cash Flow Forecast to Anticipate Future Account Needs

Forecasting cash flow is a convenient way to estimate when your business has surplus cash and when you don’t. How will it help my business, though? Good question!

Generally, a cash flow forecast gives insights into how you plan your expenditure so that your organization is never short on cash. You can easily make one without any prior knowledge of accounting or finance.

Here are four steps of how to create one:

Pick a Timeline

The first step is to judge how long you want to forecast the cash flow. It can be anywhere between weeks or many months. For new businesses, try to make a short cash flow forecast since there’s less information about your sales pipeline.

You also want to keep it small because the further you predict, inaccuracies become more probable. In simple words, choose an appropriate time frame that helps you understand your cash flow. The same does not apply to big establishments since you already have plenty of data from the previous years.

Note Your Income

Once you have your timeline ready, go ahead and segregate the columns into months or weeks. To note each type of income, put it down in different rows so that it's easy to record them.

Keep track of all the sales, invoices, and bank payments your business will receive and subsequently add them to this sheet. However, you have to put these figures when there’s actual cash in your bank.

Apart from that, you can also include the following incomes:

- Investments from Owners

- Grants

- Royalties

- Tax Refund

**In the end, estimate the total net income. **

Note Your Outgoings

As you have listed all the incomes, you'll now need to register all outgoings and expenses. So, this includes all the money going out of your bank. For example, rent, salaries, subscriptions, tax bills, marketing expenses, etc. Lastly, sum the entire amount and note the total outgoings.

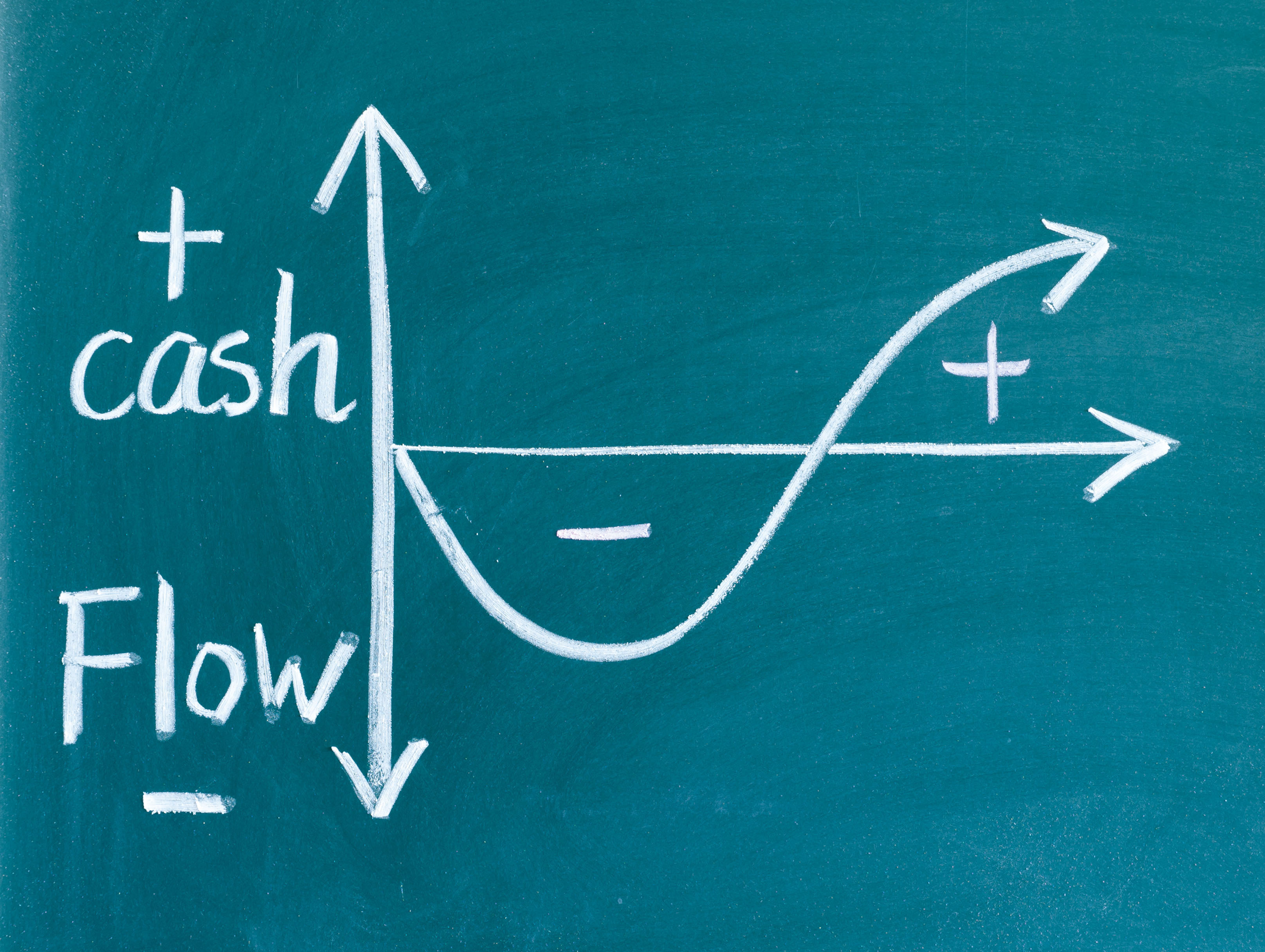

Determine Cash Flow

Cash Flow = Net Inflow- Net Outflow

Sounds simple, right? Doing so will give you either a negative figure (your business is spending more) or a positive (earning more). Both these scenarios give insights into the cash flow of your company.

Let’s say your business has a negative cash flow. This means you need to cut down on unnecessary costs to compensate for the deficit cash in your bank. On the other hand, a positive total indicates your firm has sufficient cash to upgrade or invest.

Utilizing Account Analysis Statements to Identify Areas for Improvement

As businesses generally operate a checking account, a bank may provide a detailed monthly account analysis statement which can be sent electronically or on paper. You could also place a request to receive the statement if it is not sent already.

This statement would provide you with a summary of your checking account, service charges, average balances, float, and so on. The breakdown of information and analysis can reflect your available funds, giving you a quick evaluation of your cash position. Based on this, firms can assess whether the balance is enough to offset the costs.

Additionally, the account analysis statements are also useful to identify which activity needs more improvement and can be efficiently utilized in the future. Recognizing these areas helps businesses check places where spending can be cut back.

Oh, and let’s not forget how this data can also discover the cash inflow and outflow or any irregularities to make informed decision-making.

Conclusion

As a business, you should focus on strategies to leverage profits and maximize cash flow in your account. Following a few key practices will significantly help your company avoid losses and maintain sufficient balance. To learn even more about how business checking accounts work, you can check out our reviews of banks here.

Frequently Asked Questions

What tools are useful for monitoring business account balances effectively?

- Online banking apps: These provide real-time access to your account balances and transactions.

- Financial management software: Tools like QuickBooks or Xero can integrate with your accounts to offer advanced analytics and forecasting.

- Cash flow management tools: Specialized tools that help predict future cash flows based on historical data and upcoming bills.

Are there risks involved in optimizing account balances?

Yes, risks include underestimating cash needs which can lead to overdraft fees or insufficient funds when unexpected expenses arise. To mitigate this, always maintain a buffer of readily available funds and regularly review cash flow forecasts.

How often should I review my business's cash flow strategy?

Regularly reviewing your cash flow strategy is crucial. Monthly reviews are recommended, but more frequent checks may be necessary depending on the volatility of your business cycle or during periods of significant change in your business.

Edited by:

Bryan Huynh

•

Product Tester & Writer