- Home

- Business Banking

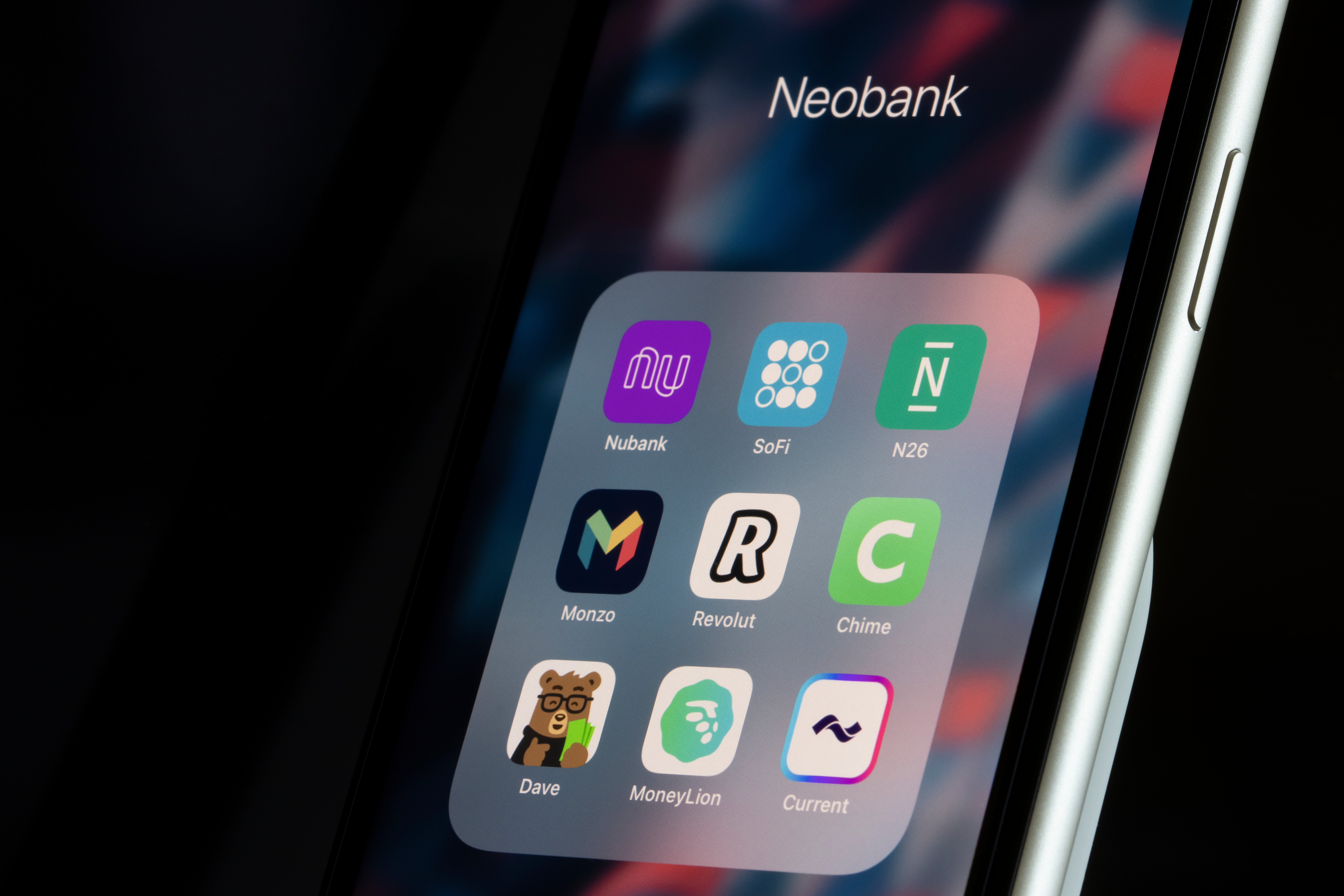

- What Is a Neobank? A Comprehensive Guide to the Digital-Only Banks Changing the Financial Landscape

What Is a Neobank? A Comprehensive Guide to the Digital-Only Banks Changing the Financial Landscape

Key Takeaways

- Neobanks are online-only banks that offer services like account management and payments without physical branches, focusing on digital convenience.

- They often feature lower fees and higher savings rates than traditional banks, along with advanced tech for budgeting and personalized advice.

- Neobanks cater to a wide audience, including underserved groups, using technology to minimize costs and enhance customer experience.

- Their revenue comes from fees, transaction charges, and partnerships, emphasizing cost-efficiency and customized banking solutions.

- Despite benefits like flexibility and lower costs, neobanks lack physical branches and may offer fewer banking services compared to traditional banks.

Are you ready to take control of your finances? Then, it’s time you experience the convenience and flexibility that comes with digital banking! Allow us to introduce you to the world of Neobanks, the future of banking. Switching to a neobank can offer you a wide range of benefits, such as higher interest rates, lower fees, and advanced technology that traditional banks can't match. With just a few clicks, you can open an account, manage your finances, and even make payments on the go.

Read on to learn more about this opportunity to upgrade your banking experience and join the thousands of satisfied customers who have already made the switch to a neobank.

What Is a Neobank?

A Neobank, also known as a digital or mobile-only bank, is a type of financial institution that operates solely online or through a mobile app. Neobanks do not have physical branches and rely on digital channels to provide customer banking services. These services include opening accounts, managing finances, making payments, and providing loans.

Neobanks are typically geared toward consumers and small businesses. They offer a wide range of services similar to traditional banks but focus on ease of use, technology, and flexibility. Neobanks also offer higher interest rates on savings accounts and lower fees than traditional banks. Due to the rise of technology and the increasing demand for digital banking services, Neobanks have become a popular alternative to traditional banks.

Neobanks Vs. Traditional Banks

Neobanks and traditional banks offer many of the same financial services, such as checking and savings accounts, credit cards, loans, and other financial products. However, there are some key differences between the two types of banks.

- Virtual vs. Physical: One of the main differences is that neobanks operate solely online or through a mobile app, while traditional banks have physical branches. This means that neobanks are more accessible and convenient for customers, as they can manage their finances from anywhere and anytime using their mobile devices.

- Lower Fees and Higher Interest Rates: Another difference is that neobanks typically have lower fees and higher interest rates on savings accounts than traditional banks. Because neobanks do not physical locations, they save on operating and maintenance costs that are passed down to their users. This can make them more attractive to customers looking to maximize their savings and minimize fees.

- Technologically Advanced: Neobanks are more focused on technology and usually have more advanced mobile apps and online banking platforms that allow customers to perform a wide range of banking activities. They also offer features such as budgeting tools, automatic savings plans, and personalized financial advice.

In summary, neobanks and traditional banks have their own pros and cons. Choosing one or the other depends on the customers' preferences and needs. Neobanks focus on technology, convenience, and lower fees, while traditional banks offer more personalized service and face-to-face interactions.

Unique Characteristics and Features of Neobanks

Neobanks have several unique characteristics that set them apart from traditional banks. Here are a few of the most notable ones:

- Digital-Only: Neobanks are digital-only financial institutions that operate solely online or through a mobile app. They do not have physical branches, which makes them more convenient and accessible for customers.

- Low Fees: Neobanks typically have lower fees than traditional banks for services such as account maintenance, transactions, and ATM withdrawals.

- High-Interest Rates: Neobanks often offer higher interest rates on savings accounts to help customers maximize their savings.

- Advanced Technology: Neobanks are built around technology and are designed to be user-friendly and easy to use. They offer advanced mobile apps and online banking platforms that allow customers to perform a wide range of banking activities on the go.

- Personalized Financial Advice: Neobanks also offer features such as budgeting tools, automatic savings plans, and personalized financial guidance to help customers manage their finances better.

- Flexibility: Neobanks offer more flexibility in terms of account opening and account management. Customers can open an account in minutes and manage it from anywhere, at any time.

- Security: Neobanks use the latest software technologies and protocols to keep customers' data and money safe.

- Inclusivity: Neobanks are more inclusive, catering to underbanked and unbanked populations. They facilitate banking access and services to people who would otherwise not have access to them.

Overall, Neobanks offer a unique combination of convenience, flexibility, and cost savings that traditional banks may not be able to match. They are designed to be easy to use and help customers manage their finances more efficiently.

How Do Neobanks Operate - The Business Model of a Neobank

The business model of neobanks is based on providing digital-only banking services to customers through a mobile app or website. They typically generate revenue through a combination of account maintenance fees, transaction fees, and interest on loans and savings accounts.

One of the key aspects of the neobank business model is the use of technology to automate processes and reduce costs. This allows them to offer a wide range of services at a lower cost than traditional banks. For example, neobanks can use digital identity verification to open accounts, eliminating the need for physical branches and reducing the cost of account setup.

Another aspect of the neobank business model is the use of data and analytics to understand customer behavior and offer personalized services. This can include financial advice, budgeting tools, and automatic savings plans.

Neobanks also generate revenue through partnerships and collaborations with financial institutions, merchants, and other organizations. For example, some neobanks partner with other banks to offer their customers access to a more extensive network of ATMs or with merchants to offer cashback or discounts on purchases.

Overall, the business model of neobanks is focused on providing a wide range of services at a lower cost through the use of technology, data, and partnerships. By leveraging these elements, neobanks can offer customers a more convenient, flexible, and personalized banking experience.

Overview of the Types of Products and Services Offered by Neobanks

Neobanks typically offer a wide range of products and services similar to traditional banks, including:

- Checking and Savings Accounts: Neobanks offer both checking and savings accounts that can be opened and managed digitally. These accounts typically have lower fees and higher interest rates than traditional banks.

- Credit Cards: Neobanks also offer credit cards that can be used for online and offline purchases. Some neobanks also offer cashback or rewards for using their credit cards.

- Personal Loans: Some neobanks provide personal loans to customers, which can be used for various purposes, such as home improvement, debt consolidation, or starting a business.

- Investment and Wealth Management: Some neobanks also offer investment and wealth management services, which allow customers to invest in stocks, bonds, and other financial products.

- Insurance: Neobanks also have a decent repertoire of insurance products, such as travel insurance, health insurance, and life insurance.

- Mobile Banking: Neobanks offer advanced mobile banking apps and online platforms that allow customers to perform a wide range of banking activities, such as checking account balances, making payments, and managing their finances.

A Comparison of Neobanking Services With Traditional Banking Services

When comparing a neobank’s services to a traditional bank, there are several key differences:

- Convenience and Accessibility: Neobanks offer digital-only banking services that can be accessed anywhere and anytime through a mobile app or website. On the other hand, traditional banks typically have physical branches that are only open during certain hours.

- Low Fees and High-Interest Rates: Neobanks often have lower fees and higher interest rates on savings accounts than traditional banks.

- Advanced Technology: Neobanks use advanced technology to automate transactional processes and offer a more convenient and personalized banking experience. Traditional banks may not have the same level of technology integration.

- Personalized Financial Advice: Neobanks also offer features such as budgeting tools, automatic savings plans, and personalized financial advice. Traditional banks do not provide these custom financial plans and guidance to all customers.

- Inclusivity: Neobanks provide financial services to individuals who may have difficulty accessing traditional banking options. They offer inclusive solutions that allow people who may have been previously excluded from having access to conventional banking services due to unforeseen circumstances.

To sum it up, neobanks and traditional banks may offer similar financial products, but neobanks typically emphasize ease of use, innovative technology, and individualized experience. On the other hand, traditional banks may put more emphasis on in-person interactions and having more physical locations.

Pros and Cons of Using a Neobank

There are several pros and cons of using a neobank. Here are some of the most notable ones:

The Pros of Using a Neobank

- Low Fees: Neobanks often have lower fees than traditional banks for services such as account maintenance, transactions, and ATM withdrawals.

- High-Interest Rates: Neobanks provide higher savings account yields than traditional banks.

- Advanced Technology: Neobanks leverage technology to streamline processes and provide a more user-friendly and personalized banking experience.

- Personalized Financial Advice: Neobanks often have tools such as budgeting, automatic savings, and personalized financial guidance to assist customers in managing their money.

- Flexibility: Neobanks offer more flexibility in terms of account opening and account management. Customers can open an account in minutes and manage it from anywhere, at any time.

- Inclusivity: Neobanks extend banking services to individuals who may not have access to traditional banking options.

- Digital-First Approach: Neobanks are built from the ground up with a digital-first approach, which means that their mobile apps and online portals are intuitive, user-friendly, and often feature-rich. This makes it easy for customers to manage their accounts, complete transactions, and access financial services anytime.

- Security: Neobanks use advanced security measures such as biometrics, encryption, and two-factor authentication to protect customer data and transactions. This makes it more difficult for fraudsters to access customer accounts and steal their money.

- Customizable Features: Neobanks offer a range of customizable features that allow customers to tailor their banking experience to their specific needs. For example, some neobanks allow customers to set up custom notifications, create sub-accounts, or link their accounts to other financial services like investments.

The Cons of Using a Neobank

- No Physical Locations: Neobanks do not have physical branches, which can limit the accessibility to some customers.

- Lack of FDIC Insurance: Neobanks may not be FDIC-insured, so deposits may not be insured by the federal government.

- Limited Services: Neobanks may offer a different range of services than traditional banks, like they may offer limited access to physical cash, fewer mortgage options, business loans, check deposit options, wealth management services, and so on.

- Customer Support: Neobanks may rely on technology to answer general customer queries and hence offer a lower level of customer support than traditional banks, making resolving issues or getting answers to unique questions more challenging.

- Fewer Account Types: Neobanks may not offer the same range of account types as traditional banks, such as joint accounts, student accounts, and senior accounts.

- Restricted Credit History Access: Some neobanks may be unable to pull credit history from traditional credit bureaus, making it more difficult to approve loans and credit cards.

The Future Outlook for Neobanks

The future outlook for neobanks is generally favorable. The increasing demand for digital banking services and the rising popularity of neobanks suggest they have a promising future. As per a study by Grand View Research, the value of the global neobanking market was recorded to be $47.39 billion in 2021. The research also suggests that this market is anticipated to witness a significant growth rate of 53.4% between 2022 and 2030. This is due to the increasing adoption of digital banking services, growing smartphone users, and increased focus on financial inclusion.

As technology advances and customers demand more convenient and personalized banking services, neobanks are likely to become an increasingly important player in the financial industry. They are well-positioned to take advantage of the growing trend toward digitalization in the banking sector and are expected to continue to grow and innovate in the future.

However, it is worth noting that neobanks are relatively new, and their long-term viability is yet to be seen. They will need to demonstrate their ability to generate sustainable profits and meet regulatory requirements to establish themselves as a viable alternative to traditional banks. Additionally, they will need to continue to innovate and adapt to changing customer needs and regulatory requirements to remain competitive in the long term.

Ready to Make the Switch to a Neobank?

In conclusion, switching to a neobank can offer a wide range of benefits, such as higher interest rates, lower fees, and advanced technology that traditional banks can't match. With just a few clicks, you can open an account, manage your finances, and even make payments on the go.

Take advantage of this opportunity to upgrade your banking experience and join the thousands of satisfied customers who have already made the switch. Sign up with a neobank today and experience the convenience, flexibility, and cost savings of digital banking.

Frequently Asked Questions

How do neobanks differ from traditional banks?

Neobanks differentiate themselves from traditional banks by lacking physical branches, focusing heavily on technology to provide faster, user-friendly services at lower costs. They often offer innovative features that traditional banks may not.

Are neobanks safe?

Most neobanks are safe as they typically partner with established banks to insure their customers' deposits up to a certain amount (like $250,000 in the U.S. under FDIC). However, it's important to check whether a particular neobank has such protections in place.

What are the benefits of using a neobank?

Benefits include lower fees, higher interest rates on savings, more intuitive apps, personalized customer service, and often, better integration with other fintech services.

Can neobanks replace traditional banks?

For some users, neobanks can completely replace traditional banks, especially if they do not require services that need in-person assistance, such as safe deposit boxes or cashier's checks.

Edited by:

Bryan Huynh

•

Product Tester & Writer