Card.com 2025 Review

Card.com Card Review – Pros, Cons and Prepaid Card Options

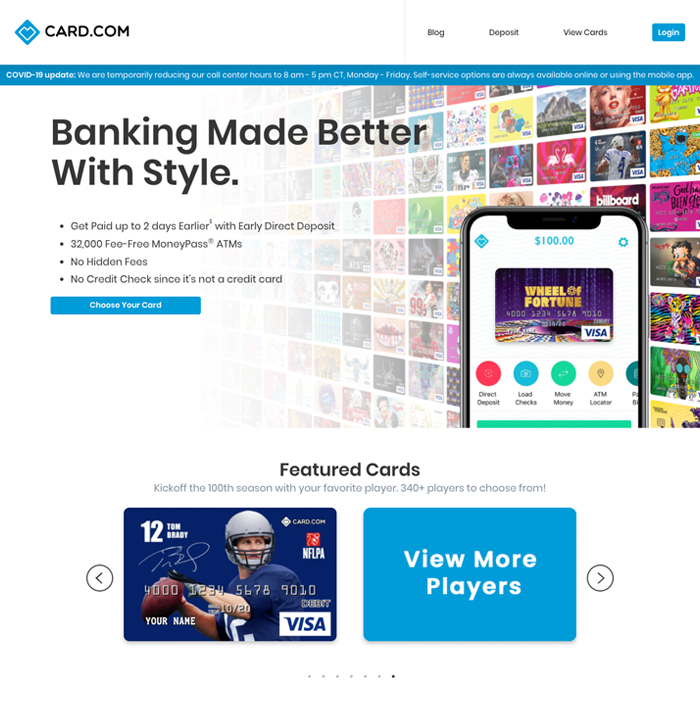

A unique way to load, spend, and budget your money using a prepaid card that works like a debit card.

In an ever-changing financial climate, consumers are looking for unique ways to spend money. Prepaid cards offer flexibility and benefits, and they are often used as a way to manage cashless transactions. In this CARD.com review, you’ll learn about one option in the world of personalized prepaid cards.

Consumers might turn to prepaid cards as a way to responsibly budget and use money each month. With direct deposits and structured transactions, prepaid cards provide a way to stay on top of spending habits. Since they act similarly to a debit card, it’s easy to swipe and use them wherever major cards are accepted.

In this review of CARD.com, you’ll have the opportunity to learn more about the company, its offerings, and why the product could be right for you. You’ll also learn more about pros, cons, and fees, so that you can take a transparent look at your financial choices.

CARD.com: What You Need to Know

CARD.com’s primary business focus is to offer “fair, fashionable, and fun online prepaid card solutions.” The company describes itself as a connection to what customers love most. This includes having the ability to spend, budget, and use money in many ways.

CARD.com is also dedicated to customer convenience. This means that the deposit options are helpful and unique, allowing customers to quickly transfer money to prepaid accounts. Customers can even share funds card-to-card, which makes it easy to use each month’s balance among friends and family.

When it comes to brand exposure, CARD.com also offers various partnership opportunities. These partnerships include big-name brands like Hearst Corporation, TLC, and National Geographic. To learn more about CARD.com’s partnerships, visit the partner page.

With CARD.com, you can bank fully from your smartphone, using a card that feels unique and personal to you! Begin the personalization process today!

How Do Prepaid Cards Work?

When you sign up for a CARD.com prepaid card, you’re signing up for more than a gift card. At the same time, having an account doesn’t require a line of credit or a credit check. This makes it a desirable option for customers who want to control spending and minimize the number of open credit cards they hold.

A CARD.com prepaid card works more like a debit card. This is because each month’s balance is controlled by a set deposit of cash. Although CARD.com doesn’t offer more in-depth banking options, each transaction you make is similar to making a purchase with a debit card.

Make Deposits

The easiest way to make deposits is to deposit cash directly, but many customers choose to set up direct deposit from an employer or benefits provider. Some cardholders also choose to deposit checks through a service called Ingo Money.

Use Cards at Thousands of Locations

** **CARD.com prepaid cards are generally accepted wherever VISA and MasterCard options are accepted. There is no fee for getting cash back at an in-network POS. Additionally, customers can use their prepaid cards to withdraw cash at any approved MoneyPass ATM without charge.

Manage Your Card and Spending

Managing your prepaid card is simple and user-friendly. CARD.com offers Android and iOS apps, real-time SMS and email alerts, and up to 3 card designs. Each of these options can be changed or controlled from within the customer’s account.

Load Cash, Choose Your Card, and Enjoy!

All CARD.com customers can deposit money or load cash in several ways, including:

- Direct Deposit from an employer

- Deposit of cash at an approved ATM

- Early Direct Deposit (get paid up to 2 days early)

- Depositing checks through the CARD.com mobile app

- Making a bank transfer from a connected bank account

- Completing virtual wallet transfers from PayPal or Google Wallet

These options are similar to traditional methods of loading money into an account and provide customers with the same streamlined experience. With CARD.com however, you can control the exact amount each month and choose from thousands of personalized card designs.

Once you’ve picked your card and deposited funds, you’re all set. Next up, it’s time to enjoy your prepaid card! CARD.com has over 300,000 fans on Facebook, showcasing the brand’s popularity and widespread application.

Where are CARD.com Options Available?

Users around the world can apply for and use a CARD.come prepaid card. Since these cards are backed by VISA and MasterCard, cardholders can use their cards wherever VISA and MasterCard are accepted. This provides many opportunities to make transactions in the United States and abroad.

Both the CARD.com prepaid VISA and MasterCards are issued by The Bancorp Bank or Central Bank of Kansas City, Members FDIC. The back of each prepaid card shares information about the issuing bank.

If you are a CARD.come user living in the state of California, you will be asked to submit a Privacy Request Form. This document certifies compliance with the California Consumer Privacy Act (CCPA). If you are not a resident of California but would also like to opt out of marketing information, you can do so by updating your Privacy Settings within your CARD.com account.

How Much Does CARD.com Cost?

Detailed information about CARD.com’s associated user fees can be located on the Fee Schedule page. These charges are divided based upon the type of card you have, and upon the account numbers of your card. As with any financial product, it’s important to know what you’re signing up for before you’re charged with an unexpected fee.

At CARD.com, fees are charged for:

- Monthly maintenance

- Out-of-network ATM withdrawals

- Cash reload, depending on how and where the card is used

The typical monthly maintenance charge for all cards is $9.95 per month. The typical charge for out-of-network ATM withdrawals is $2.95 per transaction. Cash reload can cost up to $5.95, depending on how you use and reload the card.

Any Hidden Fees?

With CARD.com, there are no overdraft or additional credit fees. Since this is not a line of credit and not a traditional bank account, there are no penalties if you spend too much. Instead, your card may be declined if the funds are inaccessible.

You can potentially avoid CARD.com’s maintenance fees by setting up a recurring monthly deposit. Direct deposits in the amount of $1,000 dollars or more prior to the 30-day billing cycle are required to waive the charges. If you are already considering Direct Deposit as an option, see what you can do to match this minimum amount.

What Type of CARD.com Cards Can I Choose?

CARD.com does not necessarily offer a wide variety of different types of cards.

There are two primary cards that you can receive:

- An approved VISA Prepaid Card, issued by the Central Bank of Kansas City

- An approved MasterCard Prepaid Card, issued by the Central Bank of Kansas City

For most customers, the issuing bank is not as much of a deciding factor. It’s more important to know which type of card you have. Both VISA and MasterCard are widely accepted by many major retailers and service providers, although there may be some exceptions. You can choose which option is best during the sign-up process.

Standard prepaid card, no line of credit

The type of card that you can get with CARD.com is a standard prepaid card with no line of credit. This means that you are not:

- Opening a checking account or other bank account

- Opening a line of credit with a credit card company

The prepaid card works independently of both of these options. It provides customers with a set amount of money to spend and distribute each month.

Bonus: Unique Designs

One of the biggest perks of CARD.com is that customers can fully customize their card design and style. Design categories include:

- Professional sports teams

- Animals and nature

- Art and fashion

- Caring and awareness

- Cartoons and comics

- Famous icons

- Plus many more

The thousands of colorful, highly personalized design choices are what make CARD.com a unique way to spend and save your money.

Pros and Cons of Using CARD.com for Prepaid Cards

Although using CARD.com is fairly straightforward, it may not be for everyone. Below are a few pros and cons that customers should be aware of.

Pros

- Personalized designs and cards can make purchases more fun.

- Customers can make deposits in a variety of ways, including through money transfers with companies like Western Union.

- Customer service is available for help and support.

- An app and customer login make it easy to track transactions.

- Cards are available for widespread use, anywhere VISA and MasterCard are accepted.

Cons

- There is no bank account associated with your prepaid card, so you may sacrifice some of the benefits associated with a banking institution.

- Using a CARD.com prepaid card doesn’t build credit history, even if you use the card responsibly.

- Some users may not like the monthly maintenance charges and ATM fees.

Any Discounts on CARD.com Prepaid Cards?

Since you don’t have to pay to get a prepaid card, there are no available discounts on the application process. Fees are distributed based on monthly usage. If you want to avoid these maintenance costs, set up a minimum Direct Deposit. This is one way to save money using a CARD.com prepaid card.

CARD.com Reviews from Happy Customers

Even if you’re new to the world of CARD.com, the company has a longstanding history of helping customers. You can explore their ratings firsthand on consumer websites like TrustPilot. On TrustPilot, CARD.com has an excellent satisfaction rating of 4.5/5 stars.

Here are some other things that reviewers had to say about using CARD.com:

“I am very happy with my account with Card.com. Their cards are personalized to my choice, and I am confident that I trust them with my private information.” - Reviewer from April 2020

“Great savings for a vacation. I enjoyed saving with this account.” - Reviewer from April 2020

“I haven’t been able to get a debit card because someone stole my identity. I’m excited that I get to save my money now!” - Review from April 2020

How to Apply for a Card on CARD.com

Applying for a prepaid card on CARD.com is quick and simple. Below are the steps you need to apply on the web.

On the Web

- To begin the application steps, visit the homepage at https://www.card.com/.

- Browse available card designs or filter by category.

- Click on the card design you want to choose.

- Submit the contact information in the form. By selecting “Next” in the online application, you agree to register with CARD.com and agree to the Privacy Policy.

- Submit any other required information.

- You may be asked to complete the Cardholder Agreement.

- Agree to all terms, set up an online account, and begin using your card once you receive it in the mail.

By App

CARD.com’s app is for managing your spending and transactions once you have an account. The app is not for the purpose of applying, although you may be able to open branching accounts once you have one in existence.

By Phone

You cannot currently apply via phone, although CARD.com has a support phone line.

How to Contact CARD.com

Address P.O. Box 543000 Omaha, NE 68154 _Please note that this is the mailing address for Cardholder Services. _ Customer Service: (866) 345-4520 Email Support: [email protected] Website: https://www.card.com/ Pinterest: https://www.pinterest.com/carddotcom/ Facebook: https://www.facebook.com/card/ Twitter: https://twitter.com/card Blog: https://www.card.com/blog

More information about how to contact CARD.com can be located on the company’s Contact Us page. There is also a comprehensive FAQ section that provides answers to many common questions about CARD.com’s services.

Does CARD.com Offer Other Financial Products?

CARD.com does not currently offer other financial products such as loans, debt consolidation, banking services, or other financial products. CARD.com’s issuing bank, the Central Bank of Kansas City, may be able to offer a more diverse list of financial products for customers looking beyond the benefits of a prepaid card.

Card.com Review – Summary

In this comprehensive CARD.com profile, you’ve gotten a complete look at:

- The important things you need to know about the company

- How the process of applying and receiving a prepaid card works

- The perks and drawbacks of using a CARD.come prepaid card

- How to contact the company if you need additional assistance

Prepaid cards can unlock many possibilities for customers who want to explore a non-traditional way of budgeting and money management. Although this method might not be for every style or need, it can certainly build financial confidence and offer a level of control.

CARD.com is an innovative company with modern options for customers who want financial flexibility. With ever-evolving designs, services, and customer support, it’s easy to see why it’s a popular choice for prepaid cards.

If you’re interested in beginning your prepaid card application process, get started today by selecting a personalized design!

Frequently Asked Questions

Is using a prepaid card similar to having a gift card?

According to the CARD.com FAQ page, these cards are unlike gift cards. Whereas a gift card to a retailer or restaurant runs out and expires, CARD.com prepaid options are designed for continual use. It is expected that customers reuse and re-load money onto their prepaid cards month after month.

Is there a credit check during the sign-up process?

Although users should be 18 years of age to apply for a CARD.com prepaid card, there is no credit check upon application. This is because a prepaid card is not a credit card, and it doesn’t open a line of credit. Whether you have excellent credit or a poor history, you can secure access to this prepaid option without a check on your credit.

Is there a fee for withdrawing money at an ATM with my prepaid card?

CARD.com offers an extensive network of fee-free ATMs. If you withdraw money from a MoneyPass (in-network) ATM, you won’t be charged a fee. When you withdraw money from an out-of-network ATM, you may incur a fee based on the Cardholder Agreement.

Can I use my card with mobile wallets, like Apple Pay?

Yes, it’s relatively easy to add your CARD.come prepaid card to a variety of mobile payment tools. These options include Apple Pay, Android Pay, and Samsung Pay. For detailed instructions on how to add a new card to any of these apps, see the individual app or mobile wallet instructions for further information.

How can I avoid maintenance fees with a direct deposit?

In order to avoid monthly fees with your CARD.com account, you must set up a Qualifying Direct Deposit. This means that money is consistently transferred to your prepaid account from an employer or benefits provider. The requirement is recurring ACH transfers, which means that other types of transfers (such as a tax refund) may not qualify as “recurring.”

Reviews for Card.com

Why leave a review about the service here?

Your reviews are a valuable source of insight for us to improve our service as well as improve the offerings. All pros and cons submitted here are evaluated and are responded. We also share these insights with our partners so that they could improve their offerings as well.

Post your review for Card.com

At TheCreditReview, we value your trust.

TheCreditReview.com is a free online resource that provides valuable content and comparison features to visitors. To keep our resources 100% free, TheCreditReview.com attempts to partner with some of the companies listed on this page, and may receive marketing compensation in exchange for clicks and calls from our site. Compensation can impact the location and order in which such companies appear on this page. All such location, order and company ratings are subject to change based on editorial decisions.

| Year Founded | 2012 |

|---|---|

| Pricing | No hidden fees |

Other Prepaid Cards Company Reviews

Featured Articles

Recently Updated Articles

No Reviews for Card.com

Be the first by submitting a review above