How To Avoid Foreclosure

Key Takeaways

- Homeowners behind on mortgage payments have multiple options (including loan modification, refinancing, reverse mortgages, and government assistance) to avoid foreclosure

- Foreclosures can be judicial (via court) or nonjudicial (no court), depending on state laws. Understanding your rights and timelines is crucial

- Options like short sales, deeds in lieu of foreclosure, mortgage forbearance, and bankruptcy can help manage or delay foreclosure proceedings

- Programs from HUD, the FHA, and nonprofits like the NFCC offer support, counseling, and tools to help homeowners stay in their homes or minimize loss

- Avoid foreclosure relief scams by watching for red flags like upfront fees or outdated program offers and work with trusted, verified sources

Falling behind on your mortgage payments can result in the possibility of foreclosure -- an incredibly devastating prospect as a homeowner.

This can happen for a number of reasons, such as losing your job or facing a divorce, but nothing can really prepare you for losing your home.

There is some good news though: you have other options before foreclosure.

Foreclosure Types

Foreclosure is the process of selling your home to pay off unpaid debt. When you are unable to pay your mortgage, your lender will use foreclosure as a last resort.

Lenders will typically mark you as delinquent when you have fallen behind your payments 90 days and if this continues, they will eventually give up on trying to collect the debt. In this case, they will either sell your loan to a collection agency or pursue the process of foreclosure.

Foreclosures allow your lender to seize your home and sell it to recoup the debt; however, you will receive any excess cash beyond your balance and fees.

Since foreclosures are regulated by state law, it's essential to know your rights in your state, along with whether you are facing a judicial or nonjudicial foreclosure.

Nonjudicial Foreclosure

A nonjudicial foreclosure requires the lender to foreclose on your home without court proceedings and is a state-permitted power of sale provision in your mortgage note or deed of trust.

Judicial Foreclosure

Judicial foreclosures are foreclosures that go through the court. This begins when you receive a notice from your lender (also called a breach letter) explaining that your mortgage is in default.

The Foreclosure Process

Generally, you will have 30 days to respond to a notice of default. Your lender can ask for immediate repayment in full; if you fail to pay it off in time, you will face foreclosure.

Your lender will then have a foreclosure trustee schedule a foreclosure sale and you will receive a notice of sale regarding the date of the auction.

At this point, you can take some steps to avoid foreclosure (more on that later).

A few states allow a redemption period that lets borrowers live in their home after the foreclosure sale; if a homeowner is able to repay the original mortgage during this period, they can avoid being evicted. If you are evicted from your home, you can be sued for a deficiency judgment.

Judicial foreclosures typically take longer to complete than nonjudicial ones -- anywhere from a few months to a few years.

Your Options To Avoid Foreclosure

Loan Refinance

There are two types of loans you can use to avoid foreclosure: refinance loans and reverse mortgages.

Refinancing your mortgage allows you to receive a new mortgage that you can use to repay your old mortgage and any delinquent payments. The terms of this refinance loan should make paying your new monthly repayments easier, but they also come with fees.

Your new loan terms may extend your repayment terms and may also reduce your interest rate. While this means your monthly payment amount is reduced, the amount you end up paying may be higher overall.

Lenders that allow you to refinance your mortgage will generally require you to have at least 25% equity in your home. However, many lenders will not be on board with refinancing -- especially if you have bad credit and are delinquent on your payments.

Some lenders that offer loan refinancing include LendingTree, Bank Of America Mortgage, and CitiMortgage. Additionally, the FHA Rate Guide can help you find providers of FHA-guaranteed refinance loans.

Reverse Mortgages

A reverse mortgage allows you to use your home equity to receive funds (in a lump sum, monthly installments, or a line of credit) in order to repay your current mortgage. The loan principal and accrued interest can be paid when you give up your home. Any remaining equity can be sent to you in monthly payments or a line of credit.

Loan refinances and reverse mortgages are a good way to avoid foreclosure, but borrowers with bad credit may have trouble qualifying for them. However, homeowners who are at least 62 years old and have equity in their home may be more likely to qualify for a reverse mortgage -- even with bad credit.

A popular reverse mortgage program offered by the Federal Housing Administration (FHA) is the Home Equity Conversion Mortgage (HECM) program. You must meet with a HECM counselor to discuss your program eligibility and information:

- Be at least 62 years old

- You must own the property or have substantial equity

- You must occupy the property

- You cannot be past due on any federal debt.

- The amount you receive is limited to the equity in your home (value of the home minus the mortgage balance)

- The amount you borrow cannot exceed the lesser of the home's appraised value

- The amount you borrow can't exceed the program limit of $765,600

- You must be able to pay expenses such as insurance, property taxes, and HOA fees.

- Your property must meet FHA and HUD property and flood requirements as a single- or multi-family home, condominium, or manufactured house.

- You are able to pay for the cost of the program, which includes mortgage insurance premiums, an origination fee, servicing fee, closing costs, and more. You can either pay this separately or roll it into the loan.

While they are helpful, a reverse mortgage can also be subject to a foreclosure, such as if the homeowner passes, sells the house, moves, or fails to pay.

(Note: A reverse mortgage can affect your access to Medicaid.)

LendingTree is a service that offers reverse mortgages. Looking for more options? The FHA Rate Guide can help you find providers of FHA-guaranteed reverse mortgages.

Loan Modification

A loan modification allows lenders to adjust your loan terms such as payment, rate, and/or amount in order to make it more affordable for you. Bad credit can make it difficult to reduce your interest rate, but you may be able to receive a longer loan term. Additionally, there are no closing costs.

During a loan modification review, lenders are not allowed to proceed with foreclosure.

The Flex Modification Program can reduce mortgage payments by around 20% and is offered to borrowers who have mortgages owned by Freddie Mac or Fannie Mae. Bank of America Mortgage is another service that provides loan modifications.

Mortgage Forbearance

If you're having trouble making your mortgage payments, your lender may be willing to create a payment plan or any foreclosure prevention options. You can even contact organizations that can contact lenders on your behalf.

Mortgage forbearance is an agreement in which a borrower can reduce or suspend payments and foreclosure proceedings for a period of time and agrees to a new mortgage repayment plan.

This is generally used for borrowers who are having temporary financial troubles due to a medical issue or unemployment.

Foreclosure Bailout

A foreclosure bailout replaces your current mortgage with a new one, which usually comes at a higher interest rate and with high origination fees and prepayment penalties.

These loans are usually risky and may increase your monthly payments that could eventually lead to another foreclosure.

You will need a minimum credit score of 500 and have substantial equity in your home. A foreclosure bailout loan amount is usually capped at 65% of your home's value.

Unfortunately, many of these loan providers are simply using borrowers to make money and leave them in worse shape. A foreclosure sale would mean the lender is reimbursed for the loan amount, fees, and interest.

If you're looking to avoid a fraudulent lender, some red flags to look for include:

- Pressure to take out a loan or sign an agreement before leading the loan terms.

- A lender that offers a Home Affordable Modification (HAMP) loan modification -- this program expired in 2016.

- Demand for an advance payment. This applies to refinance loans, reverse mortgages, and loan modification.

If you come across any unethical practices, you can report it to the Consumer Financial Protection Bureau.

Providers of foreclosure bailouts include lenders like Bank of America Mortgage and subprime lenders.

File for Bankruptcy

Bankruptcy is a serious decision, but filing one can stop a foreclosure. Lenders can appear to the bankruptcy court to continue the foreclosure, but this usually takes one to two months.

There are two types of bankruptcy:

- Chapter 7 bankruptcy: This kind of bankruptcy allows you to discharge your debts completely.

- Chapter 13 bankruptcy: This type of bankruptcy lets you restructure your debt with a payment plan, and may allow you to keep your home since it can be included in the payment plan.

Short Sale Your Home

If you are sure that you won't be able to keep your home due to lower income and a) you owe more than your home is worth or b) you are subjected to a mandatory job relocation, consider applying for a short sale with your lender.

Your lender must agree to a short sale since they must agree to receive less than the full loan balance once the home is sold.

Ask For A Deed In Lieu Of Foreclosure

While you can sign the deed to your home back to the band, lenders generally avoid this option since they can be sued by the borrower later.

Turn To Reputable Programs That Assist Homeowners

Many of the following programs are administered through the Department of Housing and Urban Development (HUD) and the US Treasury Department:

- Making Home Affordable

- Home Affordable Modification Program (HAMP)

- Principal Reduction Alternative (PRA)

- Home Affordable Refinance Program (HARP)

- Home Affordable Unemployment Program (UP)

- Emergency Homeowners’ Loan Program (EHLP)

- Home Affordable Foreclosure Alternatives (HAFA)

Contact the FHA

Consider contacting the FHA with any questions regarding foreclosure and program alternatives. You can contact them in the following ways:

- National Servicing Center: 877-622-8525

- FHA Outreach Center: 800-225-5342

- Consumers with hearing or speech impairment can call the Federal Information Relay Service: 800-877-8339

Use Local And National Resources

There are many credit counseling services and hotlines that can assist you if you are considering foreclosure:

- Court-approved credit counseling agencies

- HUD Foreclosure Avoidance Counseling

- Homeowner’s Hope Hotline

- NeighborWorks

- National Foundation for Credit Counseling (NFCC)

- National Council of State Housing Agencies (NCHSA)

At The Credit Review, we want to ensure you get the best financial assistance. Looking for additional information? Turn to our reputable services here.

Can I stop the process of foreclosure?

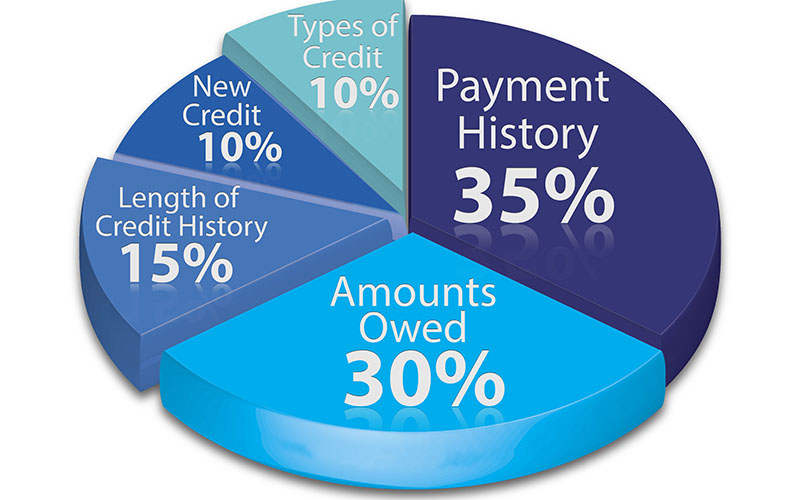

Yes, if you take the correct steps before your lender auctions your home to a new owner and the redemption period has passed. Consider turning to a reputable credit counseling agency or pursuing loan modification, loan forbearance, a reverse mortgage, or other methods. You may also want to look into credit repair after the process to improve your financial health.

Edited by:

Bryan Huynh

•

Product Tester & Writer