How Do I Improve My Credit After A Repossession?

Key Takeaways

- If you fail to make payments on a loan with collateral (e.g., a car loan), the lender can seize the asset to recover losses

- Depending on the state, repossession can happen without warning, after court approval, or even after one missed payment

- By understanding your rights, making smart credit decisions, and exploring options to repair your credit, you can recover from repossession and rebuild your financial health

What Is Repossession?

It's an exhilarating feeling to drive out of a dealership with a new car. But sometimes, life gets in the way, and you find that it is now difficult for you to make payments on your auto loan.

When you take out a loan that has collateral—such as an auto loan—it becomes the security deposit for your loan. If you fail to repay the loan to your bank or lender, you risk losing that collateral.

Repossession occurs when the bank or lender seizes that asset or property after you have defaulted on your payments and sells the asset to repay part or all your debt. Depending on the state, this could occur without warning, after permission from the court, or even after one missed payment.

A repossession can occur under other circumstances too—even if you have already paid off your property:

- Your asset or property is used as collateral for a personal loan.

- You take out a title loan on your asset and don't pay it off.

- The IRS seizes your assets and property to recoup back taxes that you owe.

- A court's judgment against you allows the creditor to seize your assets or property.

Types Of Repossession

There are two types of repossession: voluntary and involuntary.

During a voluntary repossession, you agree to return the item to a specified location or ask the lender to pick it up from your home if you find that you are unable to make your payments.

An involuntary repossession means that a lender will pursue you to pick up your vehicle or another asset any time they are allowed to and without your permission; however, they can't disturb your neighbors in the process.

Even if the lender repossesses your asset or vehicle, you're not off the hook. You may still be liable for the loan balance. If so, your lender can continue to try to collect through various means, such as by phone, mail, or a debt collection agency or even by suing you for judgment. They may also opt to auction or sell your property to cover the debt, but you are still responsible for the balance of the loan if the sale doesn't cover the entire cost.

How Does Repossession Affect My Credit?

Repossession can damage your credit score. This damage is the result of multiple factors, including the late payments and the repossession that is on the credit report. A lender can also make a judgment against you and if the debt remains unpaid, a collections account can appear on your credit report. An unpaid balance may still go into collections, which can also appear on a credit report.

- Late payments: Late payments are listed as 30, 60, 90, 120, 150 or more days late. These are on your credit reports for up to seven years.

- Repossession: When you default on your loan, lenders can repossess your vehicle. This item remains on your credit report for seven years from the initial delinquency.

- Collections: After a repossession, the lender can try to sell or auction it to recover any losses. If you still owe a balance after the sale, you must pay the remaining amount (the deficiency balance) plus any additional towing or storage fees. If you don't pay the remaining balance and fees, the account can be turned over to collections. Collections accounts remain on your credit report for up to seven years.

- Judgment: A judgment is the decision made as a result of a lawsuit in court. If a debt collector sues you and wins, a judgment is made against you. In a debt collection lawsuit, the creditor or debt collector can collect by wage garnishment or putting a lien on your home as determined by the court. A judgment remains on your credit report for up to seven years or until the statute of limitations runs out.

These items remain on your credit report for up to seven years, and although the negative effect diminishes over time, they can affect your financial options greatly. Lenders may view you as a high-risk borrower, which can make it difficult to take out loans or lines of credit in the future.

What If I Am The Cosigner?

A cosigner assists someone in receiving a loan or lower interest rate by agreeing that they'll be responsible for paying it if the primary signer doesn't. The cosigner generally has better credit and, as a result, helps the primary borrower receive ideal terms and build their credit history.

A cosigner is held equally responsible for on-time payments if the primary borrower does not make them, which means that they can face the same consequences of defaulting on a loan, including repossession. Debt collectors can also sue cosigners.

If you are a cosigner, be sure to check your credit report to check on any delinquencies. The steps a cosigner needs to take to deal with any credit damage are the same as the primary borrower (we will outline these below).

How Can I Deal With A Repossession?

When it comes to facing repossessions, you have options to avoid it.

- You may be able to contact your lender and work out an agreement to catch up on any delinquent payments. After all, they want to collect their money back in some way—whether through you or by selling your asset. Even if you only make partial payments, this may help you avoid a repossession, but you may still have to deal with the credit damage of late payments.

- If you can't make your loan payments because they are too high, you may consider refinancing your loan through a bank or credit union to receive lower interest rates or more affordable payments with a longer repayment period. Because refinancing requires you to have good credit, you should pursue this option before late payments damage your credit.

- You may want to trade in your current vehicle for something more affordable.

- Consider taking out a personal loan to pay off your auto loan. Even with bad credit, you have options available.

- The FTC outlines rules regarding how a creditor can repossess your vehicle and how they can use it to recoup their lost funds. If they violate any of these rules, they may have to pay for damages or forfeit certain rights against you.

- Consult an attorney to determine your options before you wind up with a repossession. Repossession laws can vary by state, and creditors must follow these guidelines. In many states, they must notify you of what they will do with your asset or property. Additionally, your purchase contract for your vehicle will include information on what circumstances your lender can repossess your vehicle.

- If your vehicle or other asset is repossessed, you may be able to buy it back before it goes to auction (depending on the state). You can also attempt to buy your property or vehicle back if it is being auctioned.

A repossession will appear on your credit reports around 30 to 60 days after it has occurred.

According to the FTC, you can obtain one free copy of your credit reports from the three bureaus once a year (or within 60 days of being denied for new credit) by visiting AnnualCreditReport.com.

Examine your credit reports for any inaccurate or unverifiable information (remember, only an incorrect repossession can be taken off your credit reports). If you find any inaccurate information, you can either dispute these negative items on your own or hire a reputable credit repair company to do the time-consuming legwork for you.

How Do I Rebuild My Credit After A Repossession?

If your vehicle or asset is repossessed, the damage your credit can suffer is substantial, but it doesn't have to be permanent. There are other effective ways in which you can rebuild your credit.

- Continue to pay your bills on time. Even if you have late payments and a repossession, there is no reason to let your other credit accounts fall behind. After all, payment history is the most important factor in determining your credit score.

- Lower your credit utilization. This is also an important factor in determining your FICO® score. Ideally, you want to use less than 30% of your available credit.

- Consider signing up for a secured credit card. This type of card requires you to make a deposit that you will use as collateral, and it lets you build your credit by making on-time payments.

- Sign up for a credit monitoring service to receive updates on your credit. Many credit monitoring companies offer additional services, such as identity theft protection.

Try to pay off the remaining loan balance of your repossessed item. This may not change much, but it will look better to future potential creditors. If you can't pay off the balance, the damage lessens over time, and these accounts will drop off your credit report after seven years.

If you are in need of a vehicle after repossession, you can still buy a new car -- even with bad credit. There are loans that allow high-risk borrowers to finance a new vehicle, but these interest rates and loan terms will probably be less than ideal.

The Bottom Line

Repossession can be difficult to recover from, but it isn't the end. Continue working on your credit, make informed financial choices, and look to one of our reputable credit repair services for further assistance.

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Your mortgage payments may be lower.

- You may receive a lower down payment when you purchase a cell phone.

- Your utility bills may be lower.

- Your insurance premiums depend on it.

- Potential employers may look at your credit history to determine reliability.

- It may be easier to qualify for loans.

- You may receive lower rates on loans.

- You may qualify for better credit cards.

What factors make up my credit score?

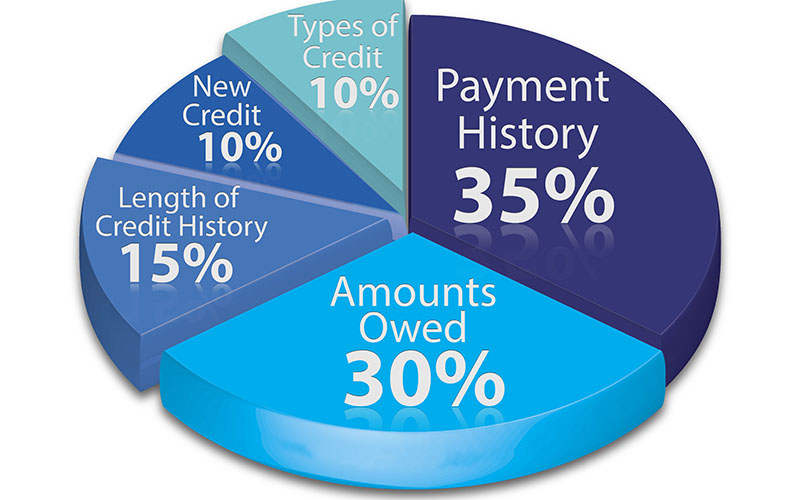

Your FICO score is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 10%

- Types of credit: 10%

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Public records

- Repossessions

- Tax liens

How can I improve my credit after a repossession?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

Edited by:

Lisa Koosis

•

Finance Expert