How to Recover from A Lifetime of Bad Credit

Key Takeaways

- Recovery is possible since credit history only goes back 7 years for most negative items

- Credit scores have a recency bias: Recent activity affects your score more than older incidents

- You can dispute inaccuracies

- Consider working with a reputable credit repair service if the process feels overwhelming

If you’ve had to deal with bad credit your entire life, due to bad decisions, complicated situations, and plain old bad luck, your financial situation might seem hopeless.

We want to assure you that your situation is absolutely NOT hopeless, and that you CAN recover, no matter how long you’ve been dealing with bad credit.

Before you understand how you can recover, you need to realize why it’s possible; no matter how bad your situation may be.

Why You Can Recover

Most of the items on your credit score only go back 7 years. Collections items, personal bankruptcies where you pay down the loan balances, loans in default, missed payments… all of these go away after 7 years. 7 years might seem like a long time, but it won’t feel like it after it passes.

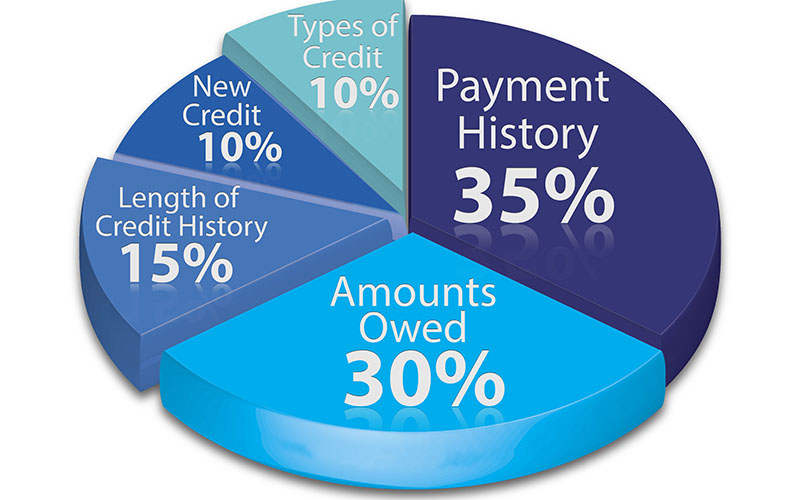

Credit scores have a strong recency bias. If you’ve paid down your credit cards recently, you will see this in action. Items on your credit report will affect your credit score the most when they first happen. For example, a loan in default that just went into collections last week will have a greater effect on your credit score than a collections item from 4 years ago.

There are items you might be able to dispute. Instances of fraud, mistakes, and items that are not supposed to be on your credit report anymore can all be disputed through the credit bureaus. Once the bureaus wipe it off your report, it will no longer affect your credit score. NOTE: You might not see this when checking your credit score through outside services, however rest assured that it is the case.

How Do You Improve Your Credit Score?

Get rid of negative items. Dispute whatever seems like a mistake or fraud, and try to arrange with lenders to get your record wiped from your credit report once a debt is settled. This won’t always work, however, and if it doesn’t you’ll be stuck with the item for seven years. HOWEVER: if the account is closed, then it will go away completely after the seven year period!

Lower your debt: especially credit card debt. Many people with bad credit have maxed out their credit cards to the point where they can’t even use them anymore. Getting rid of credit card debt will impact your score in a huge positive way!

Making Better Credit Decisions

Be careful with loans you take out. This is the easiest way to make sure that you can get yourself out of the situation you’re in. Payment history is the most important part of your credit score! People who make every payment on time have good credit, and people who don’t are at risk of having bad credit. “Stress test” yourself by saying, if I lose my job, can I still pay this debt for the next six months? If the answer is no, don’t take out that debt.

Pay off new credit card balances every month, even while you’re paying down the total. This may require cutting spending or increasing your income; however, spending more than you earn is how people get into bad credit situations in the first place.

Use simple ways to improve your credit score. We wrote an article explaining some easy, simple ways to improve your credit score. Check it out here! or look to our reputable credit repair services.

How long do negative credit items remain on my report?

Most negative items (such as collections, bankruptcies, missed payments, etc) will be removed from your credit report after 7 years. Additionally, the impact of negative items on your score decreases as the time passes from the original event.

Edited by:

Bryan Huynh

•

Product Tester & Writer