How Your Credit Score Affects Your Interest Rates

Key Takeaways

- Your credit score affects loans, housing, jobs, and insurance costs, with lower scores leading to higher interest and limited opportunities

- Lenders use your score to assess risk, impacting approval chances and loan terms for mortgages, auto loans, and more

- Even small credit score differences can cost thousands over time in higher monthly payments

- You can improve your credit by paying on time, reducing debt, disputing errors, and using tools like credit builder loans or repair services

Why Your Credit Score Is Important

Your credit score plays a surprisingly large role in your life. It can influence everything from which job you receive, approval for a loan application, and even whether or not you move into a new apartment.

It also directly impacts your interest rates. After all, a bad credit score can cost you thousands in interest during the loan term.

Why Your Credit Score Is Important To Lenders

Bad credit costs more. Why? Your credit score is a number that reflects the likelihood that you will default on a loan.

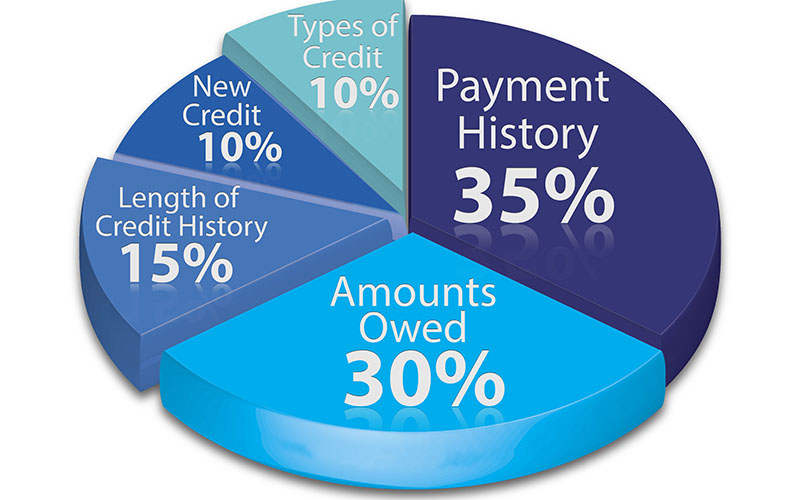

Lenders evaluate your credit history to determine how reliable you are at paying back your debts; it shows how you have managed your finances in the past. If your credit report shows any issues such as late payments or collections, lenders may take this as a sign that you may not pay your debt back in full; and a defaulted loan results in a serious loss to the bank or lender.

FICO and VantageScore are both commonly used credit scores that help lenders decide whether or not they will extend credit to you -- specifically, how likely you are to be 90 days late on a payment on an obligation owed in the next 2 years.

A good credit score means 1) you get approved for a loan and 2) you receive lower interest rates. If your scores are low and your risk of default is high, you can be denied for a loan or wind up with higher interest rates.

How Your Credit Score Impacts The Cost Of A Loan

You already know that your credit affects the cost of your loan but let's take a closer look:

Mortgages

Be sure to always check your score before you buy a house. Checking for any underlying credit and financial issues can help you avoid a headache in the long run.

Improving your credit before applying for a mortgage can potentially help you save thousands. While there is no minimum set credit score for taking out a mortgage, a better credit score means a loan with better rates and terms.

Your FICO score (which is most commonly used by lenders) falls in a range of 300 (lowest) to 850 (highest):

- Excellent: 800 to 850. 19.9% of applicants have this score and are the most likely to receive the best interest rates on loans.

- Great: 740 to 799. 18.2% of applicants have this score and are likely to receive above-average rates from lenders.

- Good: 670 to 783. 21.5% of applicants have this score and only 8% of this group are at risk of becoming delinquent.

- Fair: 580 to 669. 20.2% of applicants have this score and are considered to be unreliable borrowers.

- Poor: 300 to 579. 17% of consumers have this score and will most likely not be approved for credit; if they are, they usually have to pay a deposit or additional fees.

Each lender has its own loan criteria when determining what rates to offer you, but one thing is guaranteed: even a few points can result in a hundred dollar difference in your monthly payments and add up to the tens of thousands in the long run.

You can receive a mortgage with a low credit score but each loan type has a typical minimum credit score requirement. For example, loans such as conventional loans, USDA loans, and VA loans usually require a credit score of around 620 to 640; FHA loans accept credit scores as low 500 (with a 10% down payment) and 580 (with a 3.5% down payment); jumbo loans generally require a credit score of 720.

Auto Loans

Your car insurance premium is also affected by your credit history. Most auto insurance companies use a specific type of credit score (not your FICO score) called a credit-based insurance score to set your interest rates. Unless you live in a specific state like California, Hawaii, or Massachusetts, which prohibits this practice, your credit history is taken into account when determining insurance costs.

Not everything in your credit file is taken into account when determining your credit-based insurance score (according to the National Association of Insurance Commissioners).

The purpose of this score is to assess the risk to the insurance company by determining the likelihood that you will be in an accident and file a claim. Studies (like this one from the FTC) have shown that there is a correlation between your credit-based insurance score and accident risk.

How To Improve Your Credit

Building your credit takes time but there are a few steps you can take:

- Always pay your accounts and creditors on time

- Keep your credit utilization low; ideally you want to use less than 30% of your available credit

- Lower your debt to income ratio

- Pay off your credit cards

- Use a credit repair service or DIY credit repair to remove any erroneous or unverifiable items (like late payments, charge-offs, collections, tax liens, and more) from your credit reports

- If you are new to credit, you may not have an established credit score. In this case, you can start to build credit by starting with a credit card. If you are under 21, find a cosigner (like a parent) and add them as an authorized user.

- You can open a secured credit card or an account with a bank or credit union that has a small credit limit.

- Consider taking out a credit builder loan.

- Check your credit reports for any errors. 20% of consumers have found errors on their credit reports that could result in a less favorable loan. You can acquire a free copy of your credit report from the three bureaus once a year at AnnualCreditReport.com. If you find errors, you can dispute these items with bureaus on your own or hire a credit repair service to do the legwork for you. Around 80% of consumers who have disputed erroneous items have successfully removed them.

Not sure where to begin? Turn to our reputable credit repair companies.

How do I know if I have a good FICO score?

There are many different types of credit scores, so the score considered good varies based on which scale you are using. However, the most commonly used score is your FICO® score, which is broken down like this:

- Exceptional: 800+

- Excellent: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 579 and below

What are the different types of credit scores?

Most consumers have multiple credit scores, although the FICO® score is the most commonly used one. Other types of credit scores include:

- VantageScore

- TransRisk Credit Score

- FICO SBSS

- Auto Insurance Score

- Home Insurance Score

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Renting a house or apartment (without putting down a hefty deposit)

- Your mortgage payments will be lower

- You will receive a lower down payment when you purchase a cell phone

- Your utility bills will be lower

- Your insurance premiums depend on it

- Potential employers may look at your credit history to determine reliability

- It will be easier to qualify for loans

- You will receive lower rates on loans

- You will qualify for better credit cards

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

Edited by:

Bryan Huynh

•

Product Tester & Writer