The Guide to Charge-Offs

Key Takeaways

- Charge-offs severely damage your credit score, often dropping it by 50–100 points, and can stay on your report for up to 7 years

- You are still legally responsible for paying charge-off debts, and failure to do so can lead to lawsuits or additional collections

- Paying a charge-off can slightly improve your credit, but may also reset the statute of limitations if not handled carefully

- Charge-offs can be removed if they are inaccurate or negotiated for removal (e.g., through a “pay for delete” agreement)

- Prevent charge-offs by staying current on payments or negotiating with creditors early; credit repair services can also help

Charge-offs are a delinquency on your debt that can seriously affect your credit. While it may not be a term you are familiar with, it is important to know how this can affect your credit.

Below, we answer some frequently asked questions regarding charge-offs, including how to prevent it and fix any damage done to your credit.

Charge-Off: What It Is

A charge-off occurs when a long-standing debt (such as a credit card account) is deemed uncollectable by a creditor, written off the records, and the past due accounts are canceled. Some companies sell debts to third parties and others have an internal collection department.

When A Charge-Off Occurs

Charge-offs can happen anywhere from 3 to 6 months after a debt is past due, and resolving the debt is even harder if the debts are sold to a collection agency.

Charge-Offs Cause Credit Damage

Charge-offs are some of the most unsightly items on your credit report and result in severe damage to your credit in addition to resulting in new collections.

Why Charge-Offs Are So Bad

Charge-offs affect your score more than a late payment. These can drop your credit score 50 to 100 points, with more recent charge-offs resulting in more damage.

These hits against your credit score are a warning sign to possible lenders and can result in you being denied for future loans and credit cards. Although charge-offs are not as big of a red flag as bankruptcy or foreclosures, most mortgage lenders require that all charge-offs are removed from your credit report before you are approved for a home loan.

Always Pay Your Debts

Even though you may no longer receive collection calls, charge-offs do not mean that you can ignore the obligation of paying the debts. If the period of debt collections has not expired, you can be sued for what you owe, and if your debts have been turned over to collection agencies, you not only have charge-offs but collection accounts listed as well.

Many lenders will not give you loans or new lines of credit until you have paid off an account or the debt is past due. Keep in mind that the statute of limitations for charge-offs varies greatly on location and generally last up anywhere from 3 to 7 years (and in some states like Rhode Island, up to 10 years).

Paying A Charge-Off Improves Credit

Even when you pay off a charge-off, it will only raise your credit score by a minimal amount. However, it is still important that you pay off any debts since this is seen positively by lenders.

Paying Off Old Charge-Offs Can Be Damaging

You may find yourself with collection activities if your charge-offs are several years old. If the debt is old enough that debt collectors are not able to sue you, they may use tactics to pressure you into paying, which can reset the time on how long they have to collect. If this happens, you may end up with a judgment or lien.

If a charge-off is old enough that it will soon be off your credit report, debt collectors will try very hard to collect on past due payments. If you promise to pay on a debt, you can open yourself up to lawsuits or have creditors list your account as new, which results in a credit score drop.

How To Prevent A Charge-Off

One way to prevent charge-offs is to keep your accounts current, pay off each one in full, and make sure you are not more than 60 days past due on any debts. If you are unable to pay in full, you can come to an arrangement with the creditor.

Take notice of any bills you receive that are labeled “final notice,” and in a worst case scenario, work with creditors before any debts are sold to a collection agency. Creditors have to pay third party collection agencies to collect on their debt so they would much rather work out a deal with you.

Receiving help from experienced credit repair agencies can assist in improving your credit.

How Do I Remove A Charge-Off From My Credit Report?

Negative items like charge-offs can be removed from your credit report if they are erroneous and if the debt has not reached the statute of limitations. This means that if collection agencies have incorrect information on your paperwork, you can hire a credit repair company to remove it for you or dispute the information yourself.

While a collector can’t change the debts the original creditor reports to the bureaus, you may also be able to negotiate the removal of a charge-off by paying the creditors in full and sending a pay for delete letter. If your negotiations are successful, be sure to get it in writing from creditors or collection agencies before paying the charge-off in full. If you can reach a manager and let them know you can pay the debt as soon as possible and in full, it will be much easier to negotiate.

If you have trouble making payments, consult an agency to make a payment plan and negotiate with creditors. Keep in mind that doing this does not restart the charge-off period.

If the reason you are unable to pay is due to a medical emergency or layoff from work, you (or a credit repair agency can send a goodwill letter to creditors and ask to remove the information from your credit report.

The Bottom Line

Charge-offs show up as a serious item of your credit report, but it does not have to permanently damage your credit. With the help of credit repair and a payment plan, you can get your finances back on track.

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Renting a house or apartment (without putting down a hefty deposit)

- Your mortgage payments will be lower

- You will receive a lower down payment when you purchase a cell phone

- Your utility bills will be lower

- Your insurance premiums depend on it

- Potential employers may look at your credit history to determine reliability

- It will be easier to qualify for loans

- You will receive lower rates on loans

- You will qualify for better credit cards

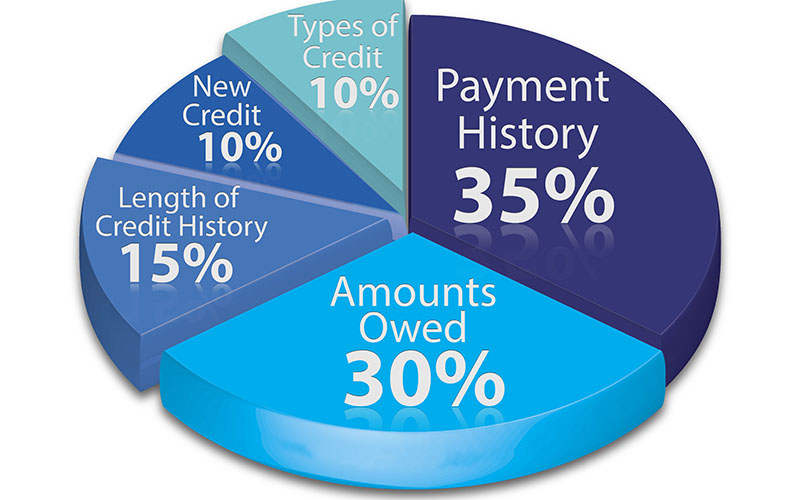

What factors make up my credit score?

Your FICO is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 15%

- Types of credit: 10%

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

How can I improve my credit after a charge-off?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

Edited by:

Bryan Huynh

•

Product Tester & Writer