How Do Public Records Affect Your Credit?

Key Takeaways

- Public records related to debt, like bankruptcy, foreclosure, and judgments, can appear on your credit report and stay for 7–10 years

- These records can severely lower your credit score, making loans and credit harder to obtain

- You can dispute and remove only inaccurate or unverifiable public records; accurate ones must remain until they expire

- Rebuilding credit after a public record involves timely payments, low credit utilization, and monitoring your credit reports

What Are Public Records?

Public records are information related to legal and financial matters. This can include financial statements, garnishments, payment history, credit repair, legal liabilities, paid debts, unpaid debts, and more.

PACER (Public Access to Court Electronic Records) is a government service provided by the federal judiciary that allows your records become public and your information to be reported to the three major credit bureaus (Experian, Equifax, and TransUnion). This electronic public access service currently hosts over 500 million case file documents and helps consumers to find case dockets from federal district, appellate, and bankruptcy courts immediately after they are electronically filed.

While it may seem like so much of your personal information is available to the public, the law requires that many of your records remain confidential due to the fact they contain your Social Security number, contact information, financial information, and information regarding your health. These records include anything that reveal your education level, income tax, criminal records, medical records, and welfare benefits.

Which Public Records Appear On My Credit Report?

Not all public records affect your credit; generally, only public records associated with debts appear on your credit report.

Your credit report has a section specifically for public records, which are also on file with local, county, state, or federal courts. These can include a small claims court in which the judge rules against you or a case in which a creditor takes legal action against you due to delinquency and the court rules in their favor.

A public record may appear on your credit report following bankrupcty, foreclosure, judgments, lawsuits, and repossessions. Depending on the item, these negative records will stay on your credit report for 7 to 10 years. These debts are serious delinquencies that can severely damage your credit and make it more difficult to take out loans or lines of credit in the future.

If you have a public record like a bankruptcy on your credit report, you will see the amount you legally owe, an exempt amount, and an asset amount for the number of personal assets the court used for their decision.

Your credit report will update as your court records are updated. Information from the courts is provided and updated either directly to the credit bureaus or by a credit bureau representative.

How Do Public Records Affect My Credit?

Because public records can remain on your credit report for 7 to 10 years, your credit can be affected for that same amount of time -- even if you repay your debts.

This negative impact on your credit can make it more difficult to take out a loan or get a new credit card since lenders use your credit to decide whether or not you are a worthy borrower.

The below public record types affect your credit in the following ways:

- Bankruptcy: Bankruptcy is often a last-ditch option for consumers in need of serious debt relief. A Chapter 7 bankruptcy does not require any repayment since it removes all debt without a repayment plan, although it may affect your credit for up to 10 years; a Chapter 13 bankruptcy requires you to repay at least some of the owed amount through a payment plan but will only remain on your credit report for 7 years.

- Foreclosure: A foreclosure allows a lender to recover their unpaid loan balance from a borrower by using the sale of their asset as collateral for the loan. While it may not be as bad as a bankruptcy, it can stay on your credit report for up to 7 years.

- Judgments: If you lose a lawsuit over an outstanding debt (such as one with a creditor), the judgment will appear on your credit report for 7 years. The information included will only indicate that you lost a lawsuit and there is a judgment against you. You may be able to settle out of court in order to avoid a public record on your credit report.

Can I Remove A Public Record From My Credit Report?

While old public records on your credit report will eventually drop off, a public record that is incorrect for any reason can be disputed and removed.

You can dispute any inaccurate or unverifiable items on your credit reports with the three major bureaus. You simply have to acquire your credit reports (which you can do for free once a year at AnnualCreditReport.com) and examine them thoroughly for any errors.

You can either fix your credit on your own or hire a reputable credit repair service to do the time-consuming legwork for you.

Keep in mind that you can only legally remove inaccurate information, so verifiable public records will remain on your credit report. Public records that involve courts and government agencies may need additional steps and procedures in order to successfully dispute with the bureaus.

Additionally, the credit bureaus no longer report items such as traffic tickets or unpaid gym memberships. They also remove civil judgments if they can't verify who is responsible for repayment, along with medical collections accounts that have been paid or are being covered by insurance.

How Do I Rebuild My Credit?

A public record can severely damage your credit but it doesn't have to be permanent. As time goes by, the damage from a public record will diminish. Aside from waiting for the item to drop off, there are several ways in which you can rebuild your credit:

- Pay your accounts on time. If you need a reminder, you can set them to autopay.

- Lower your credit utilization by paying off your debt. Ideally, you want to use less than 30% of your available credit.

- Consider opening new credit accounts.

- Use a credit monitoring service to track any changes made on your credit reports. Many of these companies even offer additional features such as identity theft protection.

The Bottom Line

If you have an inaccurate public record on your credit report, you can remove it on your own or with the help of a reputable credit repair service. For more information on credit repair, read our comprehensive guide.

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Renting a house or apartment (without putting down a hefty deposit)

- Your mortgage payments will be lower

- You will receive a lower down payment when you purchase a cell phone

- Your utility bills will be lower

- Your insurance premiums depend on it

- Potential employers may look at your credit history to determine reliability

- It will be easier to qualify for loans

- You will receive lower rates on loans

- You will qualify for better credit cards

What factors make up my credit score?

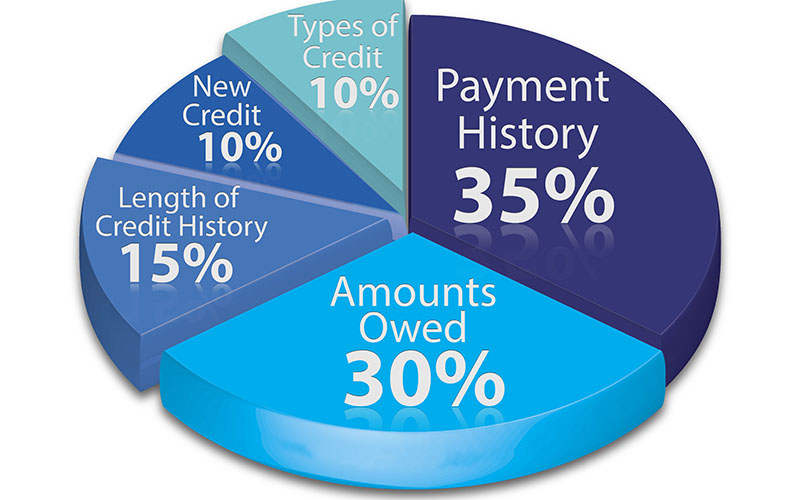

Your FICO is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 15%

- Types of credit: 10%

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

How can I improve my credit?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

Edited by:

Bryan Huynh

•

Product Tester & Writer