What Determines Your Credit Score?

Key Takeaways

- Credit scores are based on payment history, debt levels, credit history length, credit mix, and recent applications

- Multiple credit scores exist (FICO, VantageScore), but improving one often helps all

- Timely payments and low credit utilization have the biggest positive impact

- Some personal details (e.g. income, race, marital status) don’t affect credit scores

Credit scores play an important role in your life. A low credit score can make it more difficult and expensive to take out a loan or open a credit card. And even when you’re not trying to borrow money, poor credit scores can result in higher insurance premiums, extra security deposits, and trouble when renting an apartment.

Understanding the factors that impact your credit scores can be an important step in figuring out how to improve your scores. Often, these factors are grouped into five categories:

- Your payment history

- Your current debt

- The length of your credit history

- Experience with different types of credit

- Recent applications

Before diving into what contributes to each category, let’s clear up a common point of confusion about how credit scores work.

Which score? There are many credit scores

When a company requests your credit report, it can also request a score (or scores) along with the report. A scoring computer program (called a credit scoring model) will then analyze the credit report and generate a score based on the information.

FICO makes some of the most widely used scoring models, including ones that banks, lenders, and credit card issuers use to evaluate your application. It makes general scores that many types of creditors can use, and specialty scores for auto lenders and card issuers. It also updates its scoring models and has different versions of its scoring models for each of the major credit bureaus - Experian, Equifax, and TransUnion.

VantageScore is another company that makes credit scores. It’s released four versions of its score (VantageScore 1.0 through 4.0), and each scoring model works with data from all three bureaus. Although it’s not as popular as FICO, many companies use VantageScores’s credit scores instead of, or in addition to, a FICO score.

To make matters even more complex, large banks and credit card issuers also may make their own credit scoring models. And sometimes, a FICO or VantageScore credit score will be a factor in the company’s scoring model.

Once you realize there are many credit scores, it’s easy to understand why the score you saw on Credit Karma is different than your score on another website, or the score a creditor received when you applied for a loan.

The good news — most credit scores use similar formulas, and you can improve all of your scores at the same time.

The five credit scoring categories

Many of the credit scores that FICO® and VantageScore create try to determine the same thing—the likelihood that you will be 90 or more days late on a bill in the next 24 months.

The scores are also based on the same information in one of your credit reports. As a result, the actions that increase one score can often help all your scores. These credit scoring factors can be broadly grouped into five categories based on their importance in determining your scores:

Your payment history — very important

The payment history category may include:

- Whether you’ve paid your bills on time.

- If you missed a payment and how many different accounts have missed payments.

- How late payments were, as the further behind you fall the worse the impact may be on your scores.

- If any of your accounts went to collections.

- If you’ve declared bankruptcy in the least 7 to 10 years

- Other derogatory (i.e., negative) marks, such as a repossession or foreclosure.

A history of paying all your bills on time is best for your credit scores, while missing a payment can lower your scores.

Tip: You may get charged a late fee or interest right away, but a payment isn’t considered late for credit scoring purposes unless you’re 30 days past the due date. If you fall behind, try to bring your account current before this point.

Some types of accounts generally don’t get reported to the credit bureaus and won’t show up on your credit reports, such as your cell phone bill or utility payments. However, if you stop paying the bill, your account may be sent to collections, which could get reported to the credit bureaus and hurt your scores.

Your current debt — very important

The amount of revolving debt you have relative to your available credit, also known as your utilization rate or utilization ratio, is also important.

To calculate your utilization rate, add up the balances on all your credit cards, and divide the sum by the total of all your credit limits. Your overall utilization rate is an important scoring factor, and the utilization rate on each account is also important.

Generally, utilization rates don’t have a “memory” and if you can lower your utilization rate, you may be able to quickly improve your credit scores. However, some of the most recent scoring models consider trends in your credit history, such as whether you usually pay more than the minimum amount due or pay your bill in full each month.

Tip: It’s a myth that you should carry a credit card balance to improve your scores. Your balance gets reported before the due date, and you can build credit even if you pay your balance in full each month.

Also, credit scoring formulas use the balance and credit limit on your credit report to determine your utilization rate. Many credit card companies report your balance near the end of your statement period, and it may be different than your current balance.

Tip: Making a credit card payment before the end of your statement period can decrease the balance that’s reported to the credit bureau and lower your utilization rate.

Utilization is the most important factor in the category, but it’s not the only one. To a lesser extent, the number of accounts with balances and how much you owe on installment accounts (such as mortgages, auto, and student loans) is also considered.

The length of your credit history — important

The more experience you have managing credit the better. Several factors play into the credit history length category, including:

- The age of your oldest credit account.

- The age of your newest credit account.

- The average age of all the accounts in your credit report.

Having a long credit history with a high average age of accounts could be best for your scores, and it’s one reason opening a new account can lower your scores.

Tip: As long as they’re still on your credit reports, your closed accounts also contribute to your credit history length and average age of accounts.

However, you also can’t build that history without accounts. When you’re first building or rebuilding your credit, adding several accounts to your credit can be a good idea if you always pay the bill on time. After that, try to only open accounts when you truly need to.

Experience with different types of credit — important

Having experience with different types of accounts can also help your scores. Credit accounts are split into two categories:

- Revolving accounts. These are accounts that you can borrow from, repay, and then borrow from again. They include credit cards and lines of credit.

- Installment accounts. These are loans that you take out and pay in installments. They include student loans, auto loans, personal loans, and mortgages.

If you have both types of credit accounts in your credit history, even if they aren’t currently open, that can add to your credit mix.

Additionally, with industry-specific credit scores, such as FICO’s credit score for auto lenders, your experience with that particular type of account could be more significant when determining your score.

Recent applications — somewhat important

When you submit a loan or credit card application, the creditor will often review one of your credit reports and a credit score based on the report. A record of this credit check, sometimes called a credit inquiry or credit pull, gets added to your credit report. The hard inquiry (the result of a credit check during an application), can hurt your credit score a little.

A single hard inquiry won’t hurt your scores much — often, just a few points, and your scores may rise back up within a couple of months. But multiple hard inquiries can increase the negative impact.

Tip: Soft inquiries don’t lead to a lending decision and don’t impact your credit scores. These can happen when you check your own credit or apply for a soft pull preapproval or prequalification.

Fortunately, you can rate shop without worry. FICO considers multiple hard inquiries from auto loan, student loan, and mortgage applications as a single inquiry for scoring purposes if they occurred within a 14- to 45-day (depending on the scoring model) window. VantageScore treats all hard inquiries as a single inquiry if they occurred within a 14-day window.

As a result, you can submit multiple loan applications and then choose the loan with the best rate without damaging your scores.

However, submitting multiple credit card applications could hurt your FICO® scores. And, opening new accounts every month or two might continue to bring your score down.

Some things don’t impact your credit scores

Credit scores are based solely on the information in one of your credit reports. If something isn’t in your credit report, it won’t impact your score. The following isn’t in your credit report:

- Race

- Religion

- Color

- Sex

- Nationality

- Marital status

- Income

- Whether you receive public assistance

- The interest rates on your loans or credit cards

Additionally, some information is on or can be determined from your credit report but still won’t impact your scores:

- Your age

- Your name

- Where you live

- Your job or employment history

- Child support obligations

- Whether you’ve worked with a credit counselor

Tips for improving your credit scores

Your credit report is filled with moving parts that can influence your credit scores. However, your payment history and current debt are the most influential categories, and a few basic guidelines can put you well on the way to improving your credit.

- Try to make at least the minimum payments on all your accounts on time

- Keep credit card balances low or pay part of the bill early

- Think through the impact before applying for a new credit account

Additionally, review your credit reports and make sure there aren’t any incorrect negative marks that are hurting your scores. You can file a dispute to have the incorrect information corrected or removed, which may help your credit.

If you’d prefer to have a professional look over your report, top rated credit repair companies like Credit Saint work with tens of thousands of people each year to make sure they’re getting the credit they deserve.

What factors make up my credit score?

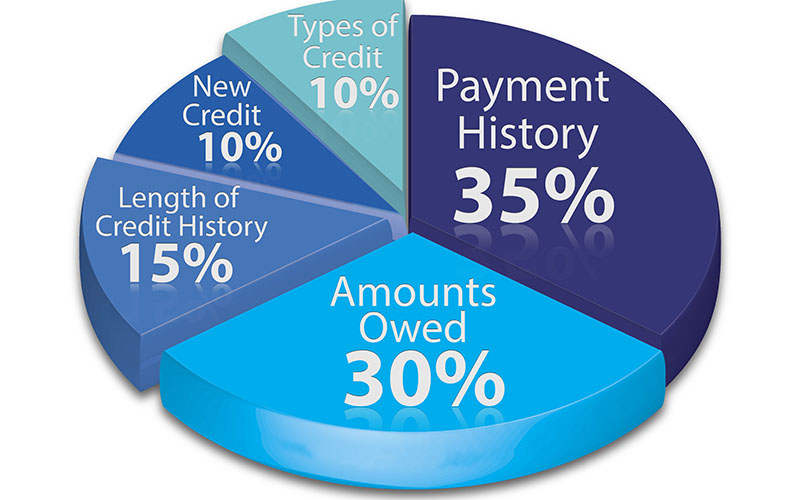

Your FICO is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 10%

- Types of credit: 10%

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

What are some steps I can take to improve my credit?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

Edited by:

Bryan Huynh

•

Product Tester & Writer