How Does A Judgment Affect My Credit?

Key Takeaways

- Judgments are legal decisions that allow creditors to collect debt through methods like wage garnishment, bank levies, and property liens

- Ignoring a lawsuit increases your risk of receiving a judgment, which can stay active for 10+ years and impact financial opportunities

- Judgments may not appear on credit reports anymore, but they still carry legal and financial consequences

- You can resolve or challenge judgments through appeals, settlements, bankruptcy, or by verifying and disputing inaccurate credit report data

- Consulting an attorney and acting promptly is crucial to protect your assets and improve your credit standing

A judgment is an official decision made as the result of a lawsuit in court. A judgment entered against you in a debt collection lawsuit allows the creditor or debt collector to collect on a debt you owe through means such as bank or wage garnishment, and even putting a lien on your home.

You are more likely to have a judgment made against you for the debt owed in a lawsuit if you ignore the lawsuit or don't respond to the lawsuit on time.

If a judgment is entered against you, the judge may choose to add extra fees (to cover any collection costs), attorney fees, and interest. Depending on the state you live in and the statute of limitations, a judgment can be valid for 10 or more years; in many states, the judgment can be renewed.

An unpaid judgment can make it difficult to purchase a home or receive lower interest rates on loans and lines of credit, so it is essential that you deal with it as soon as possible.

In the past, judgments were reported to the three major credit bureaus (Experian, Equifax, and TransUnion); however, judgments are now being removed from credit reports under certain circumstances (along with tax liens), so they may no longer a part of your credit history. Currently, the only public records being collected and kept by the bureaus are bankruptcies.

A judgment allows a creditor to receive more methods in which to collect your debt. Depending on what your state allows, this can allow them to file a levy with the court or your employer in order to do one of the following:

- Seize your bank accounts

- Garnish your wages, which allows your employer to take a percentage of your wages (before you receive it) and send it to your creditor

- Place a lien on your property, which can last several years; if you decide to sell or refinance your property after the lien, you will have to pay the judgment to your creditor fully and you will only receive the difference of the lien and sale value

- Levy your property, which allows a sheriff or officer to seize your property and publicly auction it; the sale at the auction is put towards settling your judgment

- Force the sale of your home

- Receive payment through a tax lien; this allows the government to have the first claim to your property before creditors can receive any owed debt

You can consult with an attorney following the judgment to explain what may or may not be taken by creditors. Social Security, disability payments, pension benefits, unemployment benefits, and worker's comp benefits can't be used to pay off your debt (except in the case of alimony and child support).

Why Judgments Are Being Removed From Credit Reports

Like tax liens, judgments used to be regularly reported to the credit bureaus. However, the information required to report it was minimal and if you shared the same name as someone in your state who had a judgment made against them, you were at risk of having this incorrect information reported to your credit bureau.

The Consumer Financial Protection Bureau's studies led to exposing this issue and beginning on July 1, 2017, public record data sent to the bureaus were required to include your name, address, Social Security number and/or date of birth, and was required to be updated at least every 90 days. This meant that anything that was already reported and didn't contain this data needed to be removed.

However, while a judgment can be taken off your credit report due to missing information, it does not get rid of the judgment itself.

How Do I Get Rid Of A Judgment?

There are several ways in which you can deal with a judgment. If you are simply concerned with the impact on your credit score, you can check your credit reports for any judgments or other public records. According to the FTC, you can receive a free copy of your credit reports from the three bureaus once a year at AnnualCreditReport.com.

While scouring your credit reports, look for any incorrect or unverifiable information on the reported judgment -- or if it is missing the required data for public records -- you can dispute these with the bureaus either on your own or by hiring a reputable credit repair service to do the time-consuming legwork for you.

If the judgment on your credit report is entirely correct, you may be able to deal with it in another way. You can file an appeal or ask the court to reopen a case to reverse the judgment. You can also ask to have the terms of the judgment altered. Additionally, a judgment can be discharged in a bankruptcy (although there are a few exceptions).

If creditors are able to get a partial or full amount of the debt owed, they may be more willing to settle on a judgment since they are aware that debtors may not have property that can be seized or wages that can be garnished. You can also avoid a judgment in the future by trying to settle the debt before a creditor takes you to court.

Be sure to contact an attorney to go over all of your options since the laws and statute of limitations vary by state, and be sure to always get an agreement in writing -- detailing all the terms, owed amount, and a statement confirming that the debt will not be pursued in court further -- before you pay. Follow up by checking with the court that the judgment has been updated.

The creditor will file a satisfaction of judgment once it has has been paid off (although you can complete this step on your own as well). You can also have a judgment vacated, which essentially voids the original judgment and takes it off your credit report completely, boosting your credit score in the long run.

The Bottom Line

Judgments are a serious debt that can negatively impact your credit and result in the loss of wages and property. Thankfully, there are now ways to remove it from your credit report and get you on track to financial freedom.

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Renting a house or apartment (without putting down a hefty deposit)

- Your mortgage payments will be lower

- You will receive a lower down payment when you purchase a cell phone

- Your utility bills will be lower

- Your insurance premiums depend on it

- Potential employers may look at your credit history to determine reliability

- It will be easier to qualify for loans

- You will receive lower rates on loans

- You will qualify for better credit cards

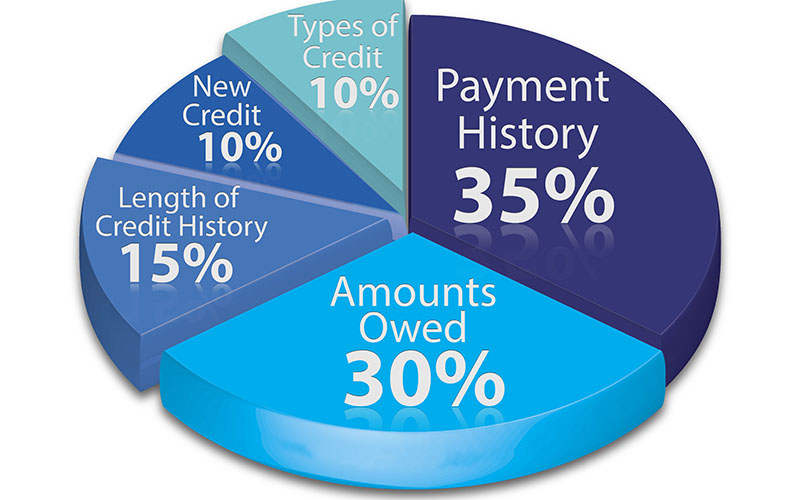

What factors make up my credit score?

Your FICO is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 15%

- Types of credit: 10%

What negative items appear on my credit report?

Your credit reports can contain both positive and negative history. Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

How can I improve my credit?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

Edited by:

Bryan Huynh

•

Product Tester & Writer