Why Are Tax Liens Being Removed From My Credit Report?

Key Takeaways

- While tax liens may no longer appear on credit reports, they still exist as public records

- If you can’t pay your taxes in full, work with the IRS to set up a payment plan

- Doing so can prevent a lien from being filed and protect your credit profile

What Is A Tax Lien?

A tax lien is placed on your property or your business's property when you have neglected to pay personal or business taxes on time and in full.

This lien, which is placed by the government, gives them the right to seize and liquidate your assets (such as inventory, real estate, vehicles) to recover any losses and owed debt. Liens are generally put in place when a consumer owes over $10,000.

Tax liens are public information, meaning that anyone -- including a potential lender -- can see these unsightly items. They indicate that you are a risky borrower and will not pay off a loan if they extend one to you.

Lenders will want to be the first to seize any collateral should you default on a loan, but if a lien is put in place, the government gets the first opportunity to do so. Because lenders will not be guaranteed any collateral, they will be much more reluctant to lend to a risky borrower.

Why Tax Liens Are Being Removed From Credit Reports

Previously, only minimal identification was required when liens were reported to bureaus. A major issue arose individuals found tax liens on their credit report that belonged to someone else with the same name and residing in the same state.

The Consumer Financial Protection Bureau led studies that exposed this issue and in March 2015, the credit bureaus agreed to change dispute investigations after reaching a settlement with the New York attorney general. The two worked together to launch the National Consumer Assistance Plan in an effort to make credit reports more accurate by removing all civil judgments and most tax liens.

The $6 million settlement resulted in 31 state attorneys general agreeing to make changes to the way credit reporting agencies investigated disputes and even removing collections not related to loans (library fines, gym memberships, and traffic tickets).

Beginning on July 1, 2017, any public records (including bankruptcies and judgments) that were to be included on credit reports were required to have the individual's name, address, and Social Security number, along with the option of including their date of birth; additionally, this information is required to be updated by the data furnisher at the courthouse once every 90 days. By April 2018, nearly 80% of tax liens had been removed from credit reports.

In the past, paid liens would remain on your credit reports for up to 7 years while unpaid liens would remain on your credit reports for up to 10 years. This change means that noncomplying tax liens can no longer negatively impact your credit score -- which is good news for the 5.5 million people who have them on their credit reports from the three major bureaus (Experian, Equifax, and TransUnion).

The Bottom Line

Tax liens that are missing complying information are now being removed from the three-bureau credit reports. This change can result in an increase in your credit score (even if the lien still exists), but you should still aim to pay your taxes on time and in full. Learn more about your tax relief options here.

We also recommend signing up for a credit monitoring service to see any changes in your credit:

And if you are still in need of improving your credit further, you can turn to a reputable credit repair company.

How does tax lien removal impact my credit?

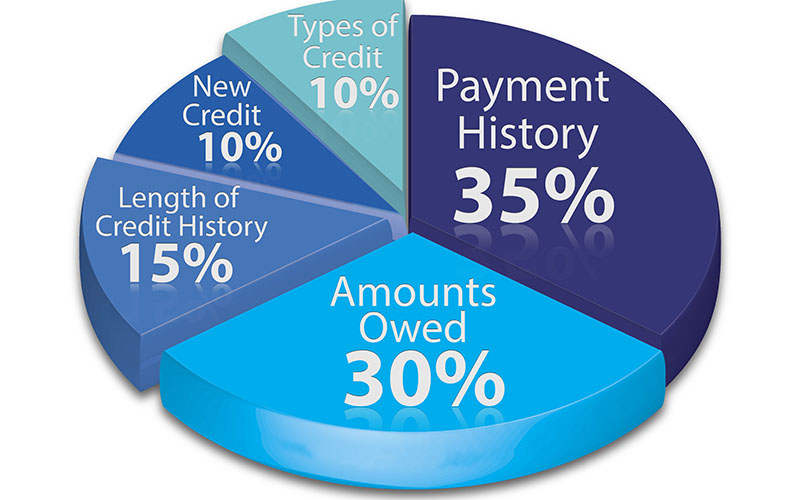

A tax lien is considered a severe derogatory mark (similar to bankruptcies, collections, charge-offs, judgments, and repossessions), but they affect consumers in different ways. The lien may not affect you as seriously if you already had strong credit, but if you were already struggling with a low credit score, then the negative impact could drastically damage your score even more.

Now that tax liens are being removed, individuals may see a modest increase -- up to 30 points -- in their score. However, even the smallest improvement to your credit score can mean the difference in receiving approval for a loan or credit card, or receiving a lower interest rate on a loan.

Even though tax liens are being taken off your credit reports, the lien itself will not go away. Lenders are looking for reliable borrowers with positive credit history, but they will still consider tax liens -- even if does not impact your credit score.

Lenders -- mortgage lenders in particular -- may look for this information on their own in order to make an informed decision on whether or not they want to lend to you.

How do I get rid of a lien?

Your first step should be to check your credit reports for tax liens (or any other unverifiable public records like a bankruptcy or judgment). You can acquire your three-bureau credit reports once a year for free at AnnualCreditReport.com.

In the case that you do find a tax lien (or any incorrect item), you can dispute this with the bureaus either on your own or through a reputable credit repair service.

Disputing and removing a tax lien will not get rid of it completely. You are still liable for any unpaid debt, so you will ideally want to pay off the lien.

If you are unable to pay your taxes on time and in full, set up a payment plan with the IRS to ensure that a tax lien will not appear on your credit report in the future.

Edited by:

Bryan Huynh

•

Product Tester & Writer