609 Letter: What It Is And How It Works

Key Takeaways

- Section 609 of the FCRA allows consumers to request full disclosure of credit report information

- A 609 dispute letter asks creditors to verify account details; unverifiable items may be removed

- Success with 609 letters varies; some negative items may reappear if verified later

- 609 letters don’t eliminate debt, but may help improve credit by removing unverifiable items

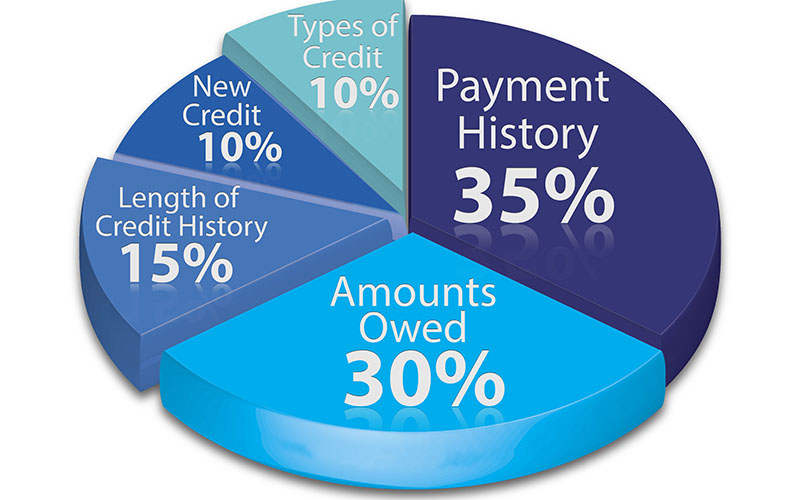

According to a study conducted by the FTC, five percent of consumers had errors on one of their three major credit reports that could impact their credit score and lead to less favorable terms for loans or insurance. Disputing and rem oving these incorrect or unverifiable items can be done through the traditional method of credit repair (either on your own or by enlisting the help of a reputable credit repair service).

While there are many different methods in which you can improve your credit, there is a little known "loophole" that can help you remove negative items from your credit report.

What Is Section 609?

The Fair Credit Reporting Act (FCRA) is a federal law that regulates access to consumer credit reports and the collection of their information.

The FCRA has 25 sections (601 through 625) and Section 609 addresses your right to request your credit reports and receive information on it. Under its Disclosure to Consumers, credit reporting agencies are required to uphold the following rights for every consumer:

- The right to request any and all information in their credit report

- The right to be informed of the source of the information

- The right to know the identification of any individual who obtained your credit report, such as a prospective employer or business (with the exception of businesses that requested access for an investigative report)

The previously listed points are typically the information you receive when you order a credit report online. In addition to this, Section 609 requires the credit bureaus (Experian, Equifax, and TransUnion) to provide the following:

- A summary of your rights under the FCRA

- A list of federal agencies who enforce the FCRA

- A statement that the credit bureaus are not required to remove negative information that is accurate (unless it is past the statute of limitations or it is unverifiable)

Under the FCRA, consumers have the right to accurate and verifiable information in their credit report. (Note: Section 609 does not give the right to dispute information or require the credit bureau to provide proof of your accounts and a description of the dispute process if a consumer requests it in writing. Those are part of Section 611 and 623.)

Creditors are required to keep accurate records of all consumer transactions, so if a credit reporting agency does not verify this information, they are required to remove the negative item from your credit report. And while Section 609 has nothing to do with actual disputes, this loophole in the law is called the "609 dispute letter" -- even though those words are not listed anywhere in the FCRA.

What Is A 609 Dispute Letter?

A 609 dispute letter is based on the loophole found in Section 609 of the FCRA that can assist you in removing negative items based on verification of information -- not inaccuracies that are usually disputed.

The 609 dispute letter requires you to write a letter to the creditor and ask for verification of the information in your file; if it was not documented correctly, the creditor is legally required to remove the negative item.

This includes situations in which the item belongs to you but can't be proven (such as agreeing to let someone pull your credit report).

Will A 609 Dispute Letter Work?

In many cases, yes -- this could be due in part to creditors taking the information and not providing the necessary (but time-consuming) paperwork.

Consumers online have stated that they have had success with 609 disputes, including getting negative items removed and ending up with a credit score increase. However, many have said that the process takes time -- sometimes up to a few months.

Like with all disputes, there is no guarantee it will work, but if you have already been working on your credit and have a couple of items that you can't get removed, then a 609 dispute letter may be your next line of attack. Even if a negative item is verified and not removed, it is worth a try.

What 609 Dispute Letters Don't Do

A quick note on 609 dispute letters: while they can be immensely helpful, they don't relieve you of any of your responsibilities since you are still responsible for paying off any debt. If a creditor sells your account to a collection agency, that debt can show up again under a different company -- even if you have disputed it and had it removed from your credit report.

Items that have been removed can also show up again if you still owe a debt or if the creditor is able to verify it at a later date. In this case, you will have to go through the dispute process again if you want the item to be removed.

Sample 609 Dispute Letter Template

How do you write a 609 dispute letter? There are many 609 dispute letter templates available online, although there is no official template and there is no proof that one template is better than another.

You can purchase a template or even hire someone to write and send dispute letters on your behalf, but we don't recommend pursuing this method. Instead, you can request disclosure of information from the credit bureaus on your own by writing to them and requesting disclosure of information under Section 609 of the FCRA.

Write your letter formally and clearly list specific information in your credit report that you want to dispute. Include your full name so the credit bureaus can identify you. Be sure to use certified mail to track your letter and ensure the bureau received your correspondence. Typically, you will wait 30 to 45 to receive a response.

Address your letter to one of the following three credit bureau addresses:

- Experian: Dispute Department, P.O. Box 9701, Allen, TX 75013

- Equifax: P.O. Box 7404256, Atlanta, GA 30374-0256

- TransUnion: Consumer Solutions, P.O. Box 2000, Chester, PA 19022-2000

609 Letter Template:

To Whom It May Concern,

I am writing to request the verification of the following information in my credit report under Section 609 of the Fair Credit Reporting Act.

(List account names and numbers you are disputing)

I would like to verify that the creditors obtained my information legally by requesting that they provide the original sources of information, including the identity of the individuals who requested my reports, related documentation, and the original contract or service agreement with my signature.

If you are unable to verify this information, please remove these items immediately to ensure the accuracy of my credit history.

Sincerely,

(Full name) (Date of birth) (Address) (Social Security number)

The Bottom Line

While 609 dispute letters can help clean up lingering items your credit report, there are other effective methods to fix your credit.

Not sure where to start? Turn to one of our top rated credit restoration services to learn more.

How should I send a 609 dispute letter to the bureaus?

Send your letter through certified mail with the return receipt requested in order to ensure that the credit bureau has received it.

Edited by:

Bryan Huynh

•

Product Tester & Writer