The Guide To Credit Restoration

Key Takeaways

- Credit restoration is a legal and effective process for removing inaccurate or unverifiable items from your credit report to boost your score

- Disputing errors and making on-time payments are critical steps in repairing and maintaining good credit

- Keeping credit utilization low and adding positive credit history (e.g., through credit builder loans or becoming an authorized user) can significantly improve your credit

- Consumers can repair their credit independently or seek help from reputable credit restoration services

- Laws like the FCRA and FACTA protect your rights in disputing credit report inaccuracies and safeguarding your financial information

When you are struggling with less-than-stellar credit, you might be missing out on financial opportunities. After all, good credit opens doors to better interest rates on personal loans and credit cards, among other financial benefits.

If you want to turn your credit around, you can use some tried and trusted credit restoration methods. Below, we break down what can seem like a challenge into a step-by-step guide to getting your credit back on track.

Credit Restoration: What It Is

Credit restoration is the process of repairing your credit by disputing and removing unverifiable or incorrect items on your credit report, resulting in a higher credit score.

The Fair Credit Reporting Act (FCRA) gives consumers the legal right to dispute any incorrect information on their credit report and requires creditors to investigate your claims and either verify the item as correct or and remove it in the case it is incorrect.

Additionally, the Fair and Accurate Credit Transactions Act (FACTA) was put forth in 2003 to prevent identity theft, improve dispute resolution, improve the accuracy of consumer records, and improve consumer access to credit information.

Credit repair can be done on your own or through a reputable credit repair service.

Credit Restoration: Is it legitimate?

Absolutely. While there are scammers in the credit restoration industry, credit restoration is perfectly legal.

When hiring a credit restoration service, look for companies with a money-back guarantee and plenty of reviews on sites such as the Better Business Bureau and Trustpilot and steer clear of services that promise they will remove any negative information and guarantee that your score will be increased.

Credit Restoration Steps

Remove Inaccurate And Unverifiable Items From Your Credit Report

As we stated earlier, you have every right to dispute any and all inaccurate and negative items on your credit report -- and you should. Negative items can remain on your credit report for seven to ten years.

You can acquire a free copy of your three-bureau credit report (from Experian, Equifax, and TransUnion) once a year at AnnualCreditReport.com..

Once you receive your credit reports, you can examine them for any inaccurate or unverifiable items to dispute (such as your personal information, any negative items, account information, and a list of credit inquiries).

Whether you choose to do it on your own or hire a credit restoration service, you should still gather as much information on any unverifiable items you find.

What Credit Report Items Can Be Removed

- Bankruptcies: Bankruptcies are taken off your credit report no later than ten years after they were filed. Chapter 13 bankruptcies stay on your credit report for seven years while Chapter 7 bankruptcies stay on your credit report for ten years.

- Charge-offs: When debts are no longer collectible, creditors eliminate them by selling it to a debt buyer, who then tries to collect the debt amount plus additional charges like interest and late fees. Of course, these debts should still be paid as soon as possible.

- Collections: Collections impact your score more than any other negative item and are more likely to have errors since debts are sold multiple times to collectors. If you can successfully dispute and remove these items, any accounts in collections may take one to two months before they are updated in your credit report.

- Public records: These court-related items include bankruptcies, judgments, and tax liens. The information listed states the name, amount, date filed, and the payment status of the account.

- Foreclosures: These items also appear on your credit report for up to seven years. However, many consumers qualify for a mortgage around two years after getting their finances together.

- Judgments: These are reported up to seven years after the lawsuit or until the statute of limitations has expired (it is usually shorter than seven years depending on state laws).

- Late Payments: Payments that are over thirty days late fall under this category (although some creditors will not report it until you owe the second payment). Late payments and delinquent accounts are reported for seven years after the final scheduled payment. Your credit report will reflect exactly how late your accounts are.

- Repossessions: These are reported for up to seven years after they were initially listed. Note: consumers are still responsible for paying off any remaining debt.

- Tax Liens: Paid tax liens are reported from the date of payment for up to seven years. Due to federal law, unpaid tax liens are kept on your credit report indefinitely, although credit bureaus can remove them after ten years.

Always Make On-Time Payments

Your credit score is made up of several factors, the main one of which is on-time payments.

There are hundreds of credit scoring models but the most commonly used ones are FICO and VantageScore. The most commonly used FICO scores range from 300 to 850:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

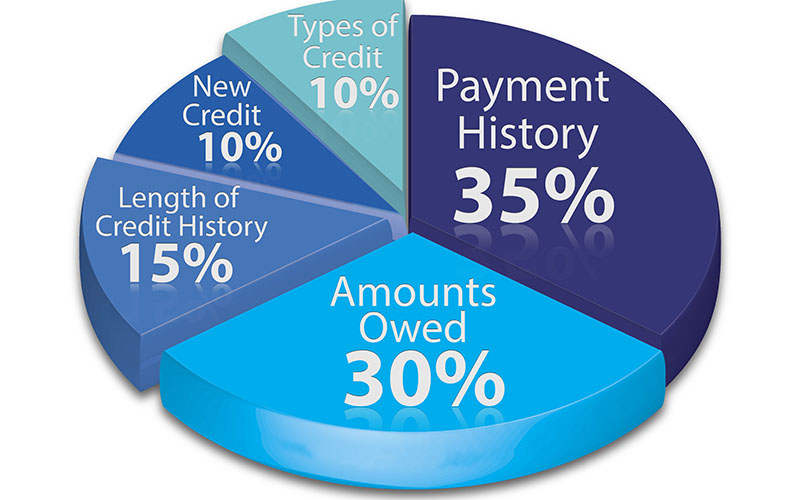

Here is a quick breakdown of your FICO score:

- Payment history: The largest factor in determining your credit score is how reliable you are at paying off your debt, which accounts for 35% of your credit score.

- Total debt: Your total amount of debt makes up 30% of your FICO® score. Debts like your credit cards are weighted more heavily than mortgages and student loans and your credit utilization also factors into your score. The more available credit you have, the better your score.

- Length of your credit history: The longer your credit accounts such as loans and credit cards have been open, the higher your credit score will be. Keep your accounts open since your credit history makes up 15% of your credit score and shows lenders that you have a reliable history of paying back your loans.

- New credit lines: 10% of your credit score consists of inquiries, such as when you put in a new credit application. Each inquiry takes off around 5 points unless there were multiple inquiries in the same time frame, which simply shows that you were looking for a new credit card or loan.

- Types of credit: 10% of your credit score is based on your different types of credit.

Based on the above, you can see that on-time payments contribute to a large amount of your score. One single late payment can drive down your score drastically, so be sure that you always pay your credit accounts on time. Consider putting your accounts on autopay to avoid any potential late payments.

Lower Your Credit Utilization

Credit utilization is the second most important factor of your FICO score, making up 30%.

Credit utilization is the amount of owed debt to the amount you borrow. You want to keep this amount low -- ideally under 30%.

If you have a high balance, try to pay it down to open some new credit. You can also ask your credit card company to increase your credit limit to open up new credit.

If you are strapped for cash, try to qualify for a new credit card since this increases your total credit line -- just be sure to use it responsibly.

Become An Authorized User

If you have a trustworthy family member or friend with good credit, consider asking to become an authorized user on their credit card. This account will show up on your credit history and positively impact your credit if you practice good financial behavior. (Note: You don't actually have to use the credit card to receive a credit boost. As long as it is being used responsibly and being paid off on time, you should see some improvement.)

Take Out A Credit Builder Loan

You can continue to add positive items to your credit by taking out a credit builder loan.

A credit builder loan is a type of loan that allows you to deposit fixed payments into an account, which you will eventually receive at the end of the loan term. The point of a credit builder loan is to build a history of on-time payments and improve your credit.

Turn To A Credit Restoration Service

A reputable credit restoration service can assist you with removing incorrect and negative items from your credit report by doing the time-consuming and intensive legwork for you.

What can I do to restore my credit?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

What are the factors make up my credit score?

Your FICO® score is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 15%

- Types of credit: 10%

What are the negative items that can appear on my credit report?

Items that negatively impact your credit include:

- Bankruptcies

- Charge-offs

- Collections

- Credit inquiries

- Foreclosures

- Judgments

- Late payments

- Loan defaults

- Past due payments

- Public records

- Repossessions

- Tax liens

Edited by:

Bryan Huynh

•

Product Tester & Writer