Why You Need Different Credit Account Types

Key Takeaways

- Your FICO® score is the most widely used credit score and ranges from 300 to 850

- Payment history and credit utilization are the two most important factors affecting your score

- You can check your credit score and report through credit bureaus, credit cards, or third-party services

- Having a mix of credit types (revolving, installment, open) can improve your score, but responsible usage is more important

- Always aim to pay on time, keep debt low, and monitor your credit regularly to build strong financial health

Your credit score is an important factor in your financial health. Simply put, it is a number that shows lenders how reliable you are at paying off your debts, and whether or not they will extend credit to you.

While there are many different credit scores, the most commonly used one is your FICO® score. This is based on the information reported to the three major credit reporting bureaus: (Experian, Equifax, and TransUnion).

Why Are Credit Scores So Important?

Credit scores greatly impact your finances since they determine your creditworthiness and more:

- It helps banks and credit card companies use these scores to decide if they are willing to extend loans for you.

- A good credit score helps you receive lower interest rates on personal loans.

- They may be used by companies when hiring new employees since steady payments show dependability.

- A good credit score allows you to be eligible for lower interest rates on loans. (However, if you have bad credit, you can still find loans with less competitive interest rates.)

- A good credit score also helps you when renting an apartment and your initial deposit may be lower with a higher credit score.

- Your credit score may also determine whether or not you pay a down payment on your cell phone.

How Can I Find My Credit Score?

- You can order your FICO® scores through the bureaus, a third party credit monitoring site like CreditKarma or Credit.com, or Fair Isaac's site at MyFico.com.

- Many credit card companies offer customers (and sometimes even non-customers) their FICO® scores for free.

- Your VantageScore can be purchased at VantageScore’s website.

- Some banks and credit cards offer credit score monitoring for a price, but they may not be the most commonly used scores like FICO® and VantageScore.

What Is A Good FICO® Score?

Since there are many different FICO® scores, the score considered "good" varies greatly.

The most commonly used FICO® score has a range of 300 to 850 and is broken down like this:

- 800+: This is an exceptional FICO® score and allows you to have an easy application process to get new credit. Only 1% of consumers with this score are likely to become delinquent. It is possible to have a perfect FICO® score of 850, but only around 0.5% of consumers have attained this.

- 740 to 799: This score is considered to be an excellent FICO® score and well above the average. Consumers with excellent credit qualify for lower interest rates on loans and credit cards and only around 2% of consumers with excellent credit will become delinquent.

- 670 to 739: This score is considered a good FICO® score and an average credit score. Around 8% of consumers with this score will default on their payments and become delinquent.

- 580 to 669: This score is considered a fair FICO® score and below the consumer average. Borrowers with this score are more likely to default on their loans, with around 28% becoming delinquent. Being approved for loans and credit is difficult and those who are approved have to pay much higher interest rates.

- 579 and below: Anything below 579 is considered a poor FICO® score and means you are likely to be rejected for credit cards and loans. Around 61% of consumers with a poor FICO® score become delinquent at some point in the future.

(Note: Some consumers don't have a FICO® score since you must have a certain amount of credit information available and at least one open account that reports to the credit bureaus for at least six months in order to generate a score.)

How Are FICO® Scores Calculated?

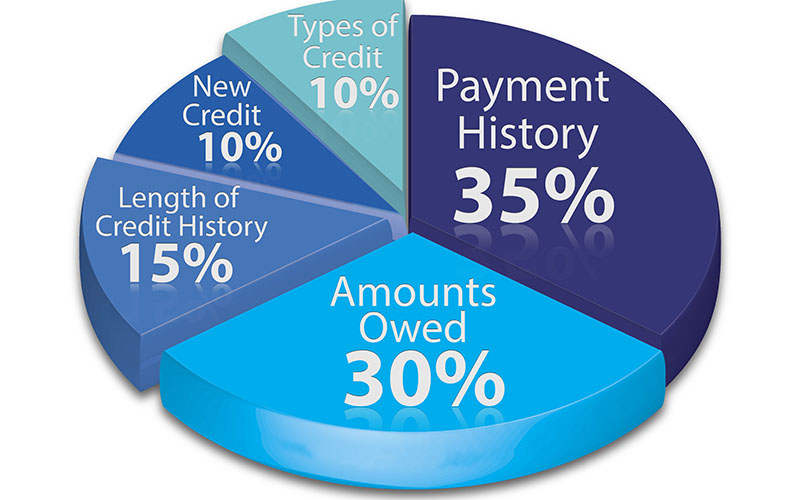

The most commonly used FICO® score is calculated in the following way:

- 35% is your payment history. The majority of your score comes down to paying your bills on time. Late payments will damage your score, and the later a payment, the more damage it will do. (This includes bankruptcies and any accounts in collections.)

- 30% is your amount owed, or how much debt you have in relation to your available credit. The less debt you owe, the better. Maxing out your credit card can result in a loss of up to 45 points.

- 15% is the length of your credit history, which includes how long you have had credit and the average age of your accounts. Avoid closing credit accounts that you don't use, since having a longer credit history and more available credit helps your score.

- 10% is new credit, or recent applications for credit. A hard inquiry can reduce your score forby up to six months.

- 10% is having a mix of credit types. Revolving credit like auto loans, mortgages, and credit cards improve your score -- and this will be our main focus in this article.

The same criteria apply to other credit score models, although they are weighted differently. For example, VantageScore grades your score on these factors (from most important to least important):

- Payment history

- Age and types of credit and credit utilization

- Total balances and amount of debt

- Hard inquiries, available credit, and recent credit-related behavior

How Can I Improve My Credit Score?

- Reduce your credit card balances. Having high credit utilization is seen negatively by creditors. Ideally, you want to use less than 30% of your available credit.

- Avoid late payments, which cause a huge hit against your credit.

- Use a secured credit card. This card requires you to put down a security deposit (which is used as collateral) while your purchases are used to build your credit history.

- Consider using a cosigner. Ask a trusted family member or friend to cosign a credit card or add you as an authorized user to one of their credit accounts in order to build a positive credit history. Remember, if one user defaults on their payments, all parties will be negatively affected.

- Take out a credit builder loan, such as one offered through Self Lender. While you can't spend the loan funds, it shows creditors that you are serious about improving your financial health.

- Repair your credit. Check your credit report to see if there are any negative items. You can get your credit report through a credit monitoring service or receive one free copy a year with AnnualCreditReport.com. You can dispute these yourself or look to a reputable credit repair company.

Why You Need A Mix Of Accounts

Making on-time payments and keeping your credit card balances low are incredibly beneficial to your score, but when you can't seem to get it any higher, what next?

One of the best methods in which you can maintain -- and improve -- your credit is to pay back your debt on time and in full. But when you're in a rut, there are other ways to improve it.

Your FICO® score takes both the type of accounts and number of accounts into consideration, but not all types of credit are created equally -- different accounts require different repayment schedules and values.

There are three types of credit accounts that impact your credit:

- Revolving accounts: This type of credit account is a type of account you can borrow against. The most commonly used forms of revolving credit are credit cards, retail credit cards, lines of credit, and HELOCs (home equity lines of credit). These credit accounts have a credit limit and require monthly payments. If you don't pay the full amount, you will be charged interest on the unpaid debt. You can borrow repeatedly as long as you pay back at least a portion of the credit limit. The biggest downside of revolving accounts such as credit cards is the risk of running up debt and winding up with a never-ending cycle of debt (with interest) that grows over time. If you're lacking revolving accounts, consider opening a credit card, secured card, or store card for some variety in your credit types. As long as you are making timely payments and keeping your balance low, revolving credit is an excellent method to diversify your credit portfolio.

- Installment accounts: These credit accounts are loans with a set amount and (mostly) fixed, regular repayment schedules. These fixed payment accounts include the following: auto loans, mortgages, personal loans, student loans, and more. Installment accounts allow you to borrow a one-time amount and pay it back with fixed monthly payments for a fixed period of time and repayment terms. Additionally, most of these usually come with fixed interest rates. If you've only ever had revolving accounts such as credit cards, adding an installment account like a credit-builder loan is a good solution.

- Open accounts: These accounts are similar to revolving accounts but allow you to borrow up to a maximum amount and be paid off in full monthly. Commonly used open accounts include your phone bill, cable bill, utilities, and charge cards.

While you should never be forced to take out loans you don't need, adding a different type of credit account can take your credit score to the next level.

Why Account Diversity Helps

Having a variety of accounts is an excellent way to build and maintain a good credit score, and as long as you are handling the accounts responsibly, lenders will view you in a positive light.

Revolving and open accounts show lenders that you can borrow and repay your loans responsibly, while installment (and also open) accounts show lenders your ability to repay loans with longer terms. (Note: Payday and title loan lenders may not report installment loans to the bureaus.)

Revolving credit also carries high interest rates and if you have many of them with high balances, lenders might believe that you have a lower monthly income.

Not all credit accounts are weighed equally. For example, mortgages are viewed as the most beneficial type of credit for two main reasons: 1) It shows that you are looking to your future with your finances and 2) If you fail to pay back the loan, lenders can seize an asset to cover the cost.

However....

While expanding your credit portfolio is a good method for improving your credit, it's not always necessary. Since it's not the most important factor in your credit score, you might want to focus on the most beneficial components of your credit score: payment history and total debt. Always pay your bills on time and aim to keep your total debt low -- after all, the more available credit, the better.

And more importantly, don't feel pressured to apply for credit that you don't plan on using. Even if you don't have a mix of loans, your score won't suffer -- it's the least relevant factor in your FICO® score. But if your goal is to reach your full potential, then taking out a mix of credit and using them responsibly is your best bet.

Remember, one or two new credit accounts of a different type of credit (used responsibly) is sufficient enough to show lenders that you can be trusted, but be wary of opening too many accounts in a short period of time -- this is a signal to lenders that you may be having financial difficulty.

The Bottom Line

How you manage your accounts is more important than the number of accounts you have. While having a mix of credit is helpful, it's not necessary unless you really want to max out your score. Whichever option you choose, make sure you handle your accounts responsibly.

Looking for ways to expand your credit portfolio? Take a look at our various financial services here.

How do I know if I have a good credit score?

There are many different types of credit scores, so the score considered good varies based on which scale you are using. However, the most commonly used score is your FICO® score, which is broken down like this:

- Exceptional: 800+

- Excellent: 740 to 799

- Good: 670 to 739

- Fair: 580 to 669

- Poor: 579 and below

What are some benefits of a good credit score?

A good credit score can help you with the following:

- Renting a house or apartment (without putting down a hefty deposit)

- Your mortgage payments will be lower

- You will receive a lower down payment when you purchase a cell phone

- Your utility bills will be lower

- Your insurance premiums depend on it

- Potential employers may look at your credit history to determine your reliability

- It will be easier to qualify for loans

- You will receive lower rates on loans

- You will qualify for better credit cards

What factors make up my credit score?

Your FICO® is made up of five factors:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit: 10%

- Types of credit: 10%

How can I improve my credit?

- Consider credit repair and contact a credit repair service

- Always pay your bills on time

- Deal with past due accounts

- Reduce your credit utilization

- Keep old credit accounts open

- Open new credit (but avoid applying for too much new credit)

- Monitor your credit

- Take out a credit builder loan

Edited by:

Bryan Huynh

•

Product Tester & Writer